Automate refinance consultations with Cal.com workflows for lenders

Automate refinance consultations with Cal.com workflows for lenders

Reduce no-shows, speed disclosures, and align teams with automated reminders, routing, and lender-friendly scheduling.

Reduce no-shows, speed disclosures, and align teams with automated reminders, routing, and lender-friendly scheduling.

Approuvé par des entreprises en forte croissance dans le monde entier

Approuvé par des entreprises en forte croissance dans le monde entier

Approuvé par des entreprises en forte croissance dans le monde entier

How it works

How it works

Set up automated refinance consultation workflows in minutes

Set up automated refinance consultation workflows in minutes

01

qualify and route borrowers

Collect borrower intent with custom intake, route by loan officer skills, state licensing, or hours, then auto-book the right refinance consultation without back-and-forth.

02

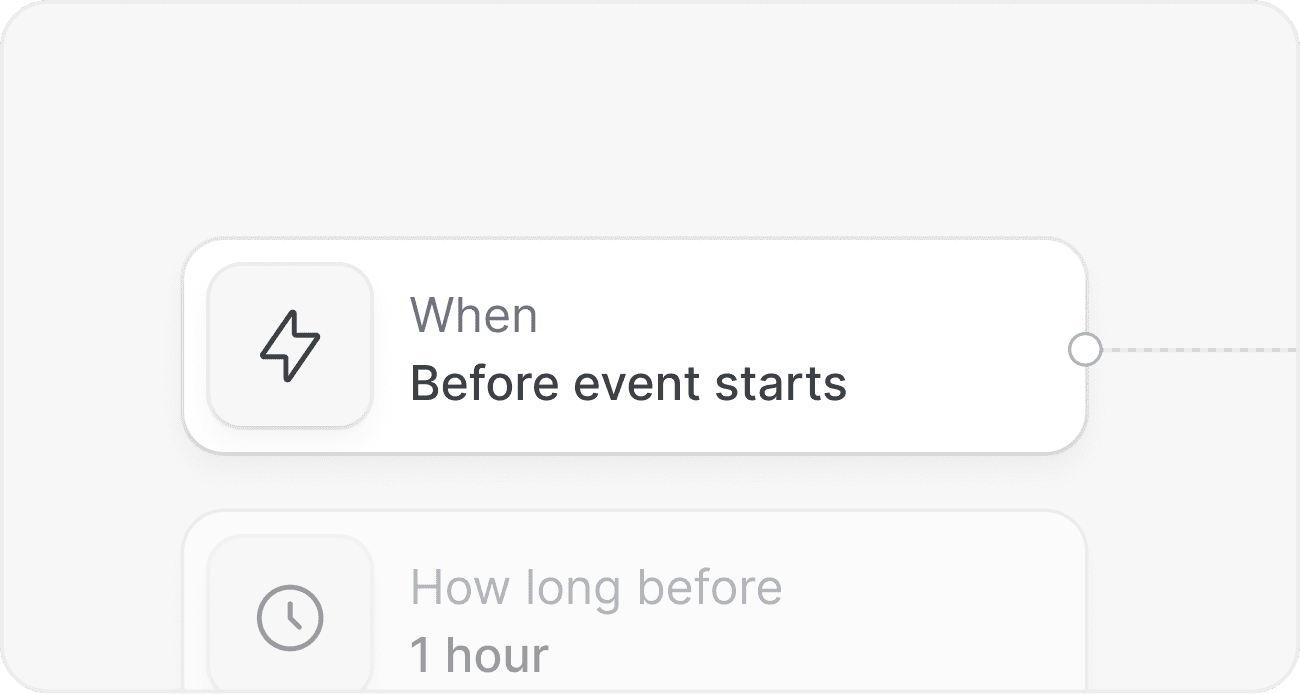

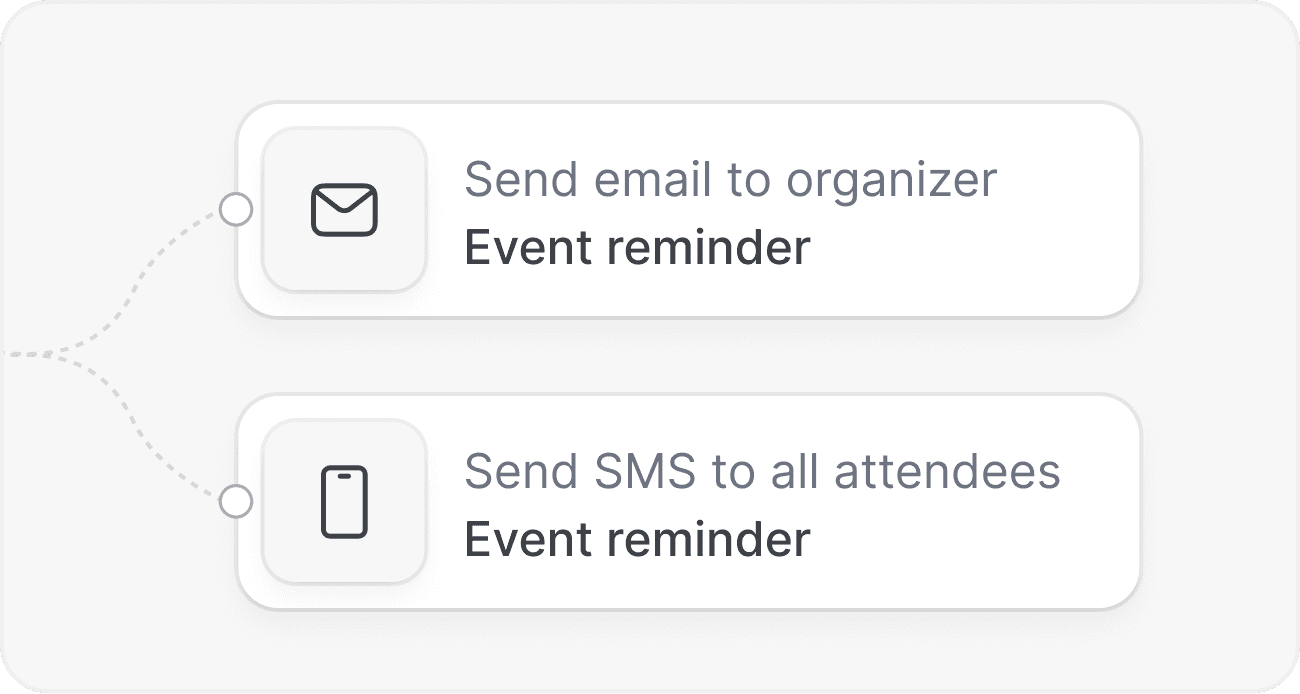

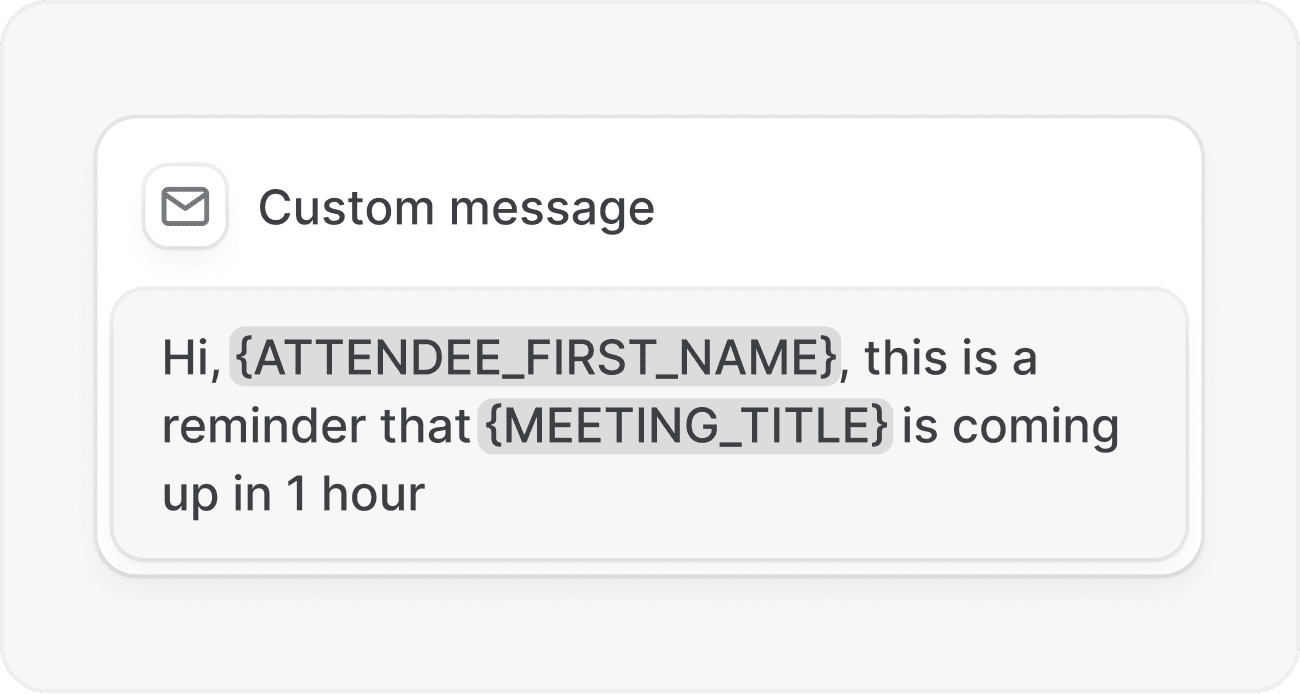

prepare with compliant reminders

Send email, SMS, or WhatsApp reminders and document checklists so borrowers show up ready, reducing delays across your refinance closing timeline.

03

follow up and move to underwriting

Trigger post-call tasks, send disclosures, update your CRM, and notify processors so you progress from consultation to underwriting without manual busywork.

Benefits of using Cal.com for refinance consultations

Benefits of using Cal.com for refinance consultations

Increase borrower conversion, simplify operations, and maintain compliance from first touch to close

Increase borrower conversion, simplify operations, and maintain compliance from first touch to close

01

accelerate time to close

Turn interest into action with automated booking links and instant routing that match borrowers to the best loan officer based on availability, state licensing, and product expertise. Reminders and document prompts ensure borrowers arrive prepared, which shortens the refinance closing timeline. By removing manual coordination and missed calls, teams keep momentum from consultation to disclosures and underwriting, cutting days from cycle time while improving borrower satisfaction.

02

reduce no-shows and cancellations

Automated, multi-channel reminders meet borrowers where they are. Share prep steps, location details, and reschedule options to prevent last-minute changes. For busy homeowners comparing refinance vs HELOC, clarity and convenience matter. Cal.com Workflows send confirmations and nudges at the right times, which keeps your pipeline predictable and your team focused on funded loans, not chasing attendance.

03

deliver a modern borrower experience

Offer a polished, accessible scheduling flow that feels tailored, not generic. With branded pages, time zone handling, and intelligent routing, borrowers can book refinance consultation times that fit their schedule. Add pre-qualification questions to set expectations and collect current rate, loan balance, and property details, so every meeting starts with context and ends with clear next steps.

04

build confidently with open scheduling infrastructure

Cal.com is open source and API-first, so lenders and fintech teams can self-host, embed scheduling, and integrate with CRMs, LOS platforms, and internal tools. Create custom workflows for disclosures, appraisal coordination, and post-close check-ins. You control data residency and permissions while giving loan officers a simple, reliable scheduling experience that scales across branches and partners.

Features that streamline refinance scheduling

Features that streamline refinance scheduling

Developer friendly, enterprise ready, and borrower focused

Developer friendly, enterprise ready, and borrower focused

intake forms with smart routing

Capture property, loan, and goal details, then route by licensing, languages, product fit, or SLA. Reduce manual triage and get borrowers to the right expert quickly.

multi-channel reminders and checklists

Email, SMS, and WhatsApp reminders reduce no-shows. Attach pre-call checklists, rate scenarios, and required documents to keep consultations productive.

round-robin and priority assignment

Balance workloads across loan officers, prioritize top producers, and honor branch hours. Configure meeting buffers, minimum notice, and rescheduling rules.

compliance-friendly self-hosting

Self-host Cal.com to keep data in your environment. Granular roles, auditability, and SSO help support lender compliance requirements.

deep integrations and webhooks

Connect your CRM and LOS, trigger webhooks after bookings, and sync outcomes to Slack or internal systems to move files from consult to underwriting.

group, phone, or video consultations

Offer in-branch, phone, or video meetings. Auto-generate secure video links and add co-hosts like processors or real estate partners when needed.

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus.

Tous vos outils clés synchronisés avec vos réunions

Cal.com fonctionne avec toutes les applications déjà dans votre flux, garantissant que tout fonctionne parfaitement ensemble.

Tous vos outils clés synchronisés avec vos réunions

Cal.com fonctionne avec toutes les applications déjà dans votre flux, garantissant que tout fonctionne parfaitement ensemble.

Tous vos outils clés synchronisés avec vos réunions

Cal.com fonctionne avec toutes les applications déjà dans votre flux, garantissant que tout fonctionne parfaitement ensemble.

Questions fréquemment posées

Questions fréquemment posées

Voici quelques-unes de nos questions les plus fréquentes.

Voici quelques-unes de nos questions les plus fréquentes.

How does Cal.com help determine when to refinance a mortgage?

Use intake questions to capture rate, term, and goals, then route borrowers to a specialist who can discuss when to refinance mortgage options during the consultation.

Can we collect documents before the refinance consultation?

Yes. Include links and checklists in reminders so borrowers bring statements, payoff letters, income docs, and IDs, making the first meeting efficient and compliant.

How do reminders reduce no-shows for refinance consultations?

Set automated email, SMS, and WhatsApp reminders with reschedule links and prep steps. Timed nudges improve attendance and keep your refinance pipeline on track.

Can Cal.com support different refinance products or refinance vs HELOC paths?

Yes. Use conditional routing to send borrowers to the right expert for conventional, FHA, VA, jumbo, or to compare refinance vs HELOC scenarios.

What about the refinance closing timeline coordination?

Trigger workflows after the call to send disclosures, notify processors, and schedule follow-ups. This reduces delays across your refinance closing timeline.

Is self-hosting available for data control and compliance?

Yes. Cal.com supports self-hosting and an API-first architecture so you can keep data in your environment while integrating with existing systems.

How do we integrate with our CRM and LOS?

Use native integrations and webhooks to create or update records after bookings, log outcomes, and kick off tasks in your CRM and LOS automatically.

How does Cal.com help determine when to refinance a mortgage?

Use intake questions to capture rate, term, and goals, then route borrowers to a specialist who can discuss when to refinance mortgage options during the consultation.

Can we collect documents before the refinance consultation?

Yes. Include links and checklists in reminders so borrowers bring statements, payoff letters, income docs, and IDs, making the first meeting efficient and compliant.

How do reminders reduce no-shows for refinance consultations?

Set automated email, SMS, and WhatsApp reminders with reschedule links and prep steps. Timed nudges improve attendance and keep your refinance pipeline on track.

Can Cal.com support different refinance products or refinance vs HELOC paths?

Yes. Use conditional routing to send borrowers to the right expert for conventional, FHA, VA, jumbo, or to compare refinance vs HELOC scenarios.

What about the refinance closing timeline coordination?

Trigger workflows after the call to send disclosures, notify processors, and schedule follow-ups. This reduces delays across your refinance closing timeline.

Is self-hosting available for data control and compliance?

Yes. Cal.com supports self-hosting and an API-first architecture so you can keep data in your environment while integrating with existing systems.

How do we integrate with our CRM and LOS?

Use native integrations and webhooks to create or update records after bookings, log outcomes, and kick off tasks in your CRM and LOS automatically.

How does Cal.com help determine when to refinance a mortgage?

Use intake questions to capture rate, term, and goals, then route borrowers to a specialist who can discuss when to refinance mortgage options during the consultation.

Can we collect documents before the refinance consultation?

Yes. Include links and checklists in reminders so borrowers bring statements, payoff letters, income docs, and IDs, making the first meeting efficient and compliant.

How do reminders reduce no-shows for refinance consultations?

Set automated email, SMS, and WhatsApp reminders with reschedule links and prep steps. Timed nudges improve attendance and keep your refinance pipeline on track.

Can Cal.com support different refinance products or refinance vs HELOC paths?

Yes. Use conditional routing to send borrowers to the right expert for conventional, FHA, VA, jumbo, or to compare refinance vs HELOC scenarios.

What about the refinance closing timeline coordination?

Trigger workflows after the call to send disclosures, notify processors, and schedule follow-ups. This reduces delays across your refinance closing timeline.

Is self-hosting available for data control and compliance?

Yes. Cal.com supports self-hosting and an API-first architecture so you can keep data in your environment while integrating with existing systems.

How do we integrate with our CRM and LOS?

Use native integrations and webhooks to create or update records after bookings, log outcomes, and kick off tasks in your CRM and LOS automatically.

Ne vous fiez pas seulement à notre parole

Nos utilisateurs sont nos meilleurs ambassadeurs. Découvrez pourquoi nous sommes le meilleur choix pour planifier des réunions.

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

Ne vous fiez pas seulement à notre parole

Nos utilisateurs sont nos meilleurs ambassadeurs. Découvrez pourquoi nous sommes le meilleur choix pour planifier des réunions.

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

Ne vous fiez pas seulement à notre parole

Nos utilisateurs sont nos meilleurs ambassadeurs. Découvrez pourquoi nous sommes le meilleur choix pour planifier des réunions.

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

"Plus élégant que Calendly, plus ouvert que SavvyCal, Cal.com fonctionne et c'est juste parfait."

Flo Merian

Marketing Produit, Mintlify

Je pense que Cal.com a une très bonne chance de créer une nouvelle catégorie en étant à la fois excellent et bien conçu.

Guillermo Rauch

PDG, Vercel

"Je viens de migrer de Calendly vers Cal.com."

Kent C. Dodds

Fondateur d'EpicWeb.dev

"Je viens de l'essayer et c'est définitivement la réunion la plus facile que j'aie jamais planifiée !"

Aria Minaei

PDG, Theatre.JS

"J'ai finalement fait le pas vers Cal.com après ne pas avoir trouvé comment modifier les événements dans le tableau de bord de Calendly."

Ant Wilson

Co-fondateur et CTO, Supabase

"At Navi, protecting personal health information is a non-negotiable, so choosing Cal.com for scheduling just makes sense."

Micah Friedland

CEO & Founder, Navi

Approuvé par des entreprises en forte croissance dans le monde entier

Approuvé par des entreprises en forte croissance dans le monde entier

Approuvé par des entreprises en forte croissance dans le monde entier

Get started with automated refinance scheduling

Start free, or talk to our team about workflows for your branch, call center, or fintech. Set up routing, reminders, and follow-ups that reduce no-shows and accelerate closings. If you are ready to scale refinance consultations without adding manual work, create your account or request a demo today.

Cal.com® et Cal® sont une marque déposée de Cal.com, Inc. Tous droits réservés.

Notre mission est de connecter un milliard de personnes d'ici 2031 grâce à la planification de calendriers.

Besoin d'aide ? [email protected] ou chat en direct.

Besoin d'aide ? [email protected] ou chat en direct.

Solutions

Cas d'utilisation

Ressources

Cal.com® et Cal® sont une marque déposée de Cal.com, Inc. Tous droits réservés.

Notre mission est de connecter un milliard de personnes d'ici 2031 grâce à la planification de calendriers.

Besoin d'aide ? [email protected] ou chat en direct.

Besoin d'aide ? [email protected] ou chat en direct.

Solutions

Cas d'utilisation

Ressources

Cal.com® et Cal® sont une marque déposée de Cal.com, Inc. Tous droits réservés.

Notre mission est de connecter un milliard de personnes d'ici 2031 grâce à la planification de calendriers.

Besoin d'aide ? [email protected] ou chat en direct.

Besoin d'aide ? [email protected] ou chat en direct.