01

qualifizieren und leiten Sie Darlehensnehmer

Erfassen Sie die Absicht des Kreditnehmers mit benutzerdefinierten Eingaben, leiten Sie nach den Fähigkeiten des Darlehensoffiziers, der staatlichen Lizenzierung oder den Öffnungszeiten, und buchen Sie dann automatisch die richtige Refinanzierungsberatung ohne Hin und Her.

02

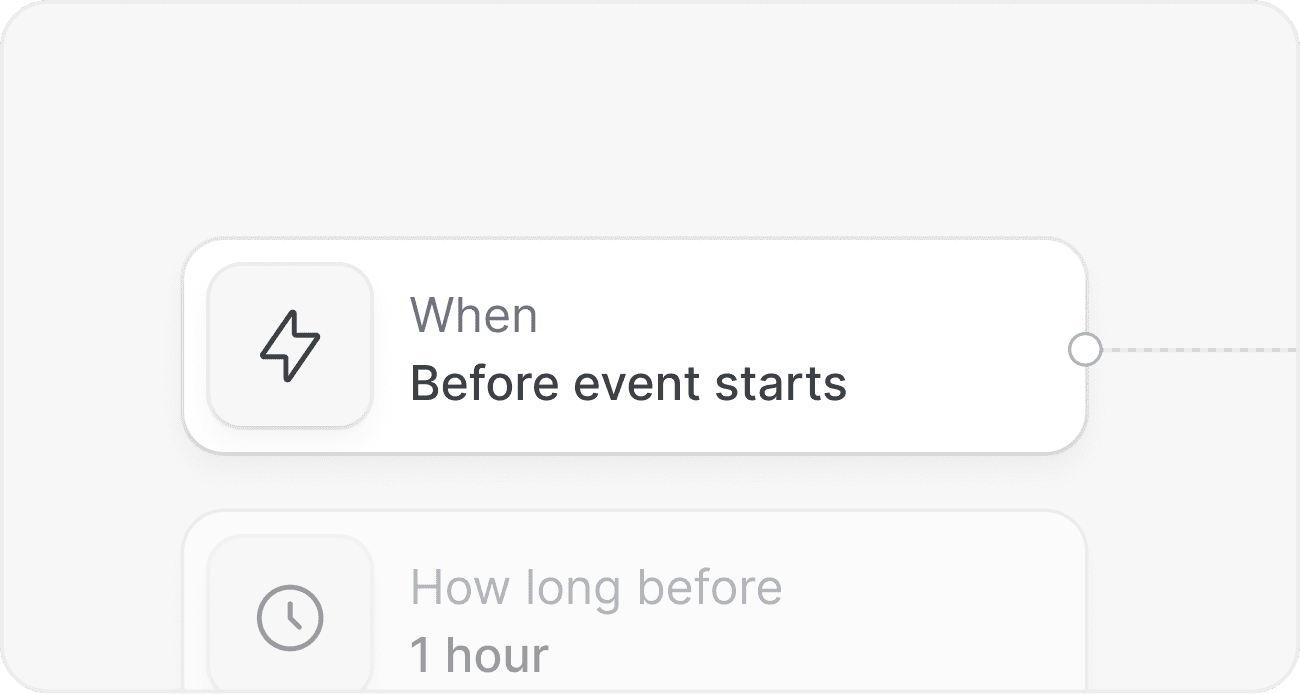

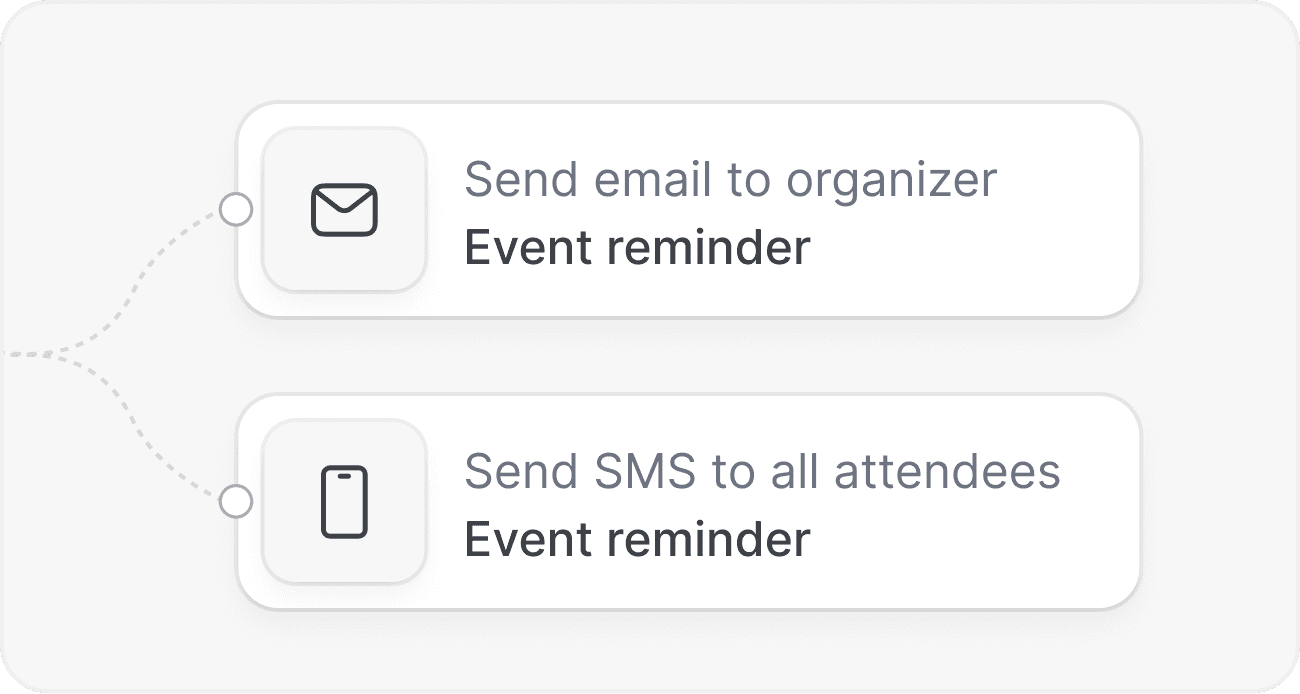

Vorbereiten mit konformen Erinnerungen

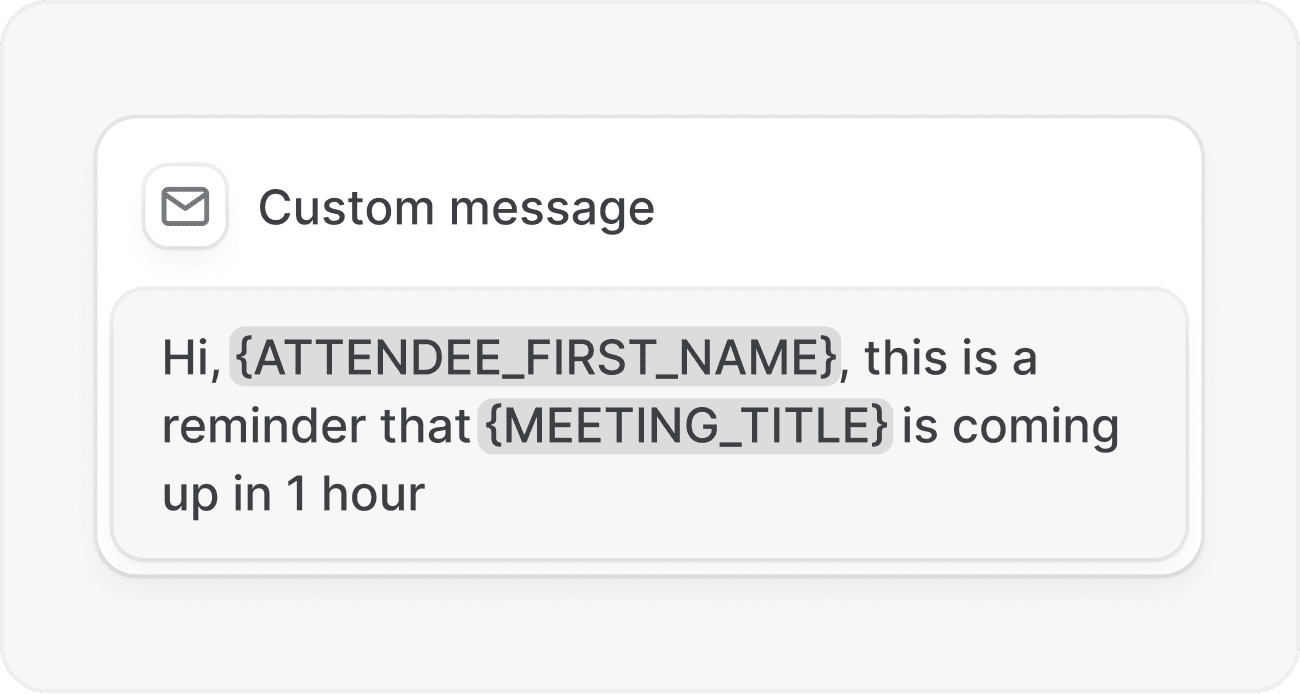

Versenden Sie E-Mail-, SMS- oder WhatsApp-Erinnerungen und Dokumenten-Checklisten, damit die Kreditnehmer bereit erscheinen und Verzögerungen in Ihrem Refinanzierungsabschlusszeitplan reduziert werden.

03

Folgen Sie nach und gehen Sie zur Underwriting.

Triggern Sie nach dem Anruf Aufgaben, senden Sie Offenlegungen, aktualisieren Sie Ihr CRM und benachrichtigen Sie die Bearbeiter, damit Sie ohne manuelle Verwaltungsarbeit von der Beratung zur Risikoprüfung übergehen.

01

Die Zeit bis zum Abschluss beschleunigen

Wandle Interesse in Aktionen um mit automatisierten Buchungslinks und sofortiger Weiterleitung, die Kreditnehmer basierend auf Verfügbarkeit, staatlicher Lizenzierung und Fachwissen über Produkte dem besten Kreditgeber zuordnen. Erinnerungen und Dokumentenaufforderungen stellen sicher, dass die Kreditnehmer vorbereitet ankommen, was den Abschlusszeitraum der Refinanzierung verkürzt. Durch die Beseitigung manueller Koordination und verpasster Anrufe behalten die Teams den Schwung von der Beratung bis zu den Offenlegungen und der Kreditvergabe bei, wodurch die Zykluszeit um Tage verkürzt und die Zufriedenheit der Kreditnehmer verbessert wird.

02

No-Show- und Stornierungen reduzieren

Automatisierte, mehrkanalige Erinnerungen treffen Kreditnehmer dort, wo sie sich befinden. Teilen Sie Vorbereitungsschritte, Standortdetails und Umschulungsoptionen, um Änderungen in letzter Minute zu vermeiden. Für vielbeschäftigte Hausbesitzer, die Refinance mit HELOC vergleichen, sind Klarheit und Komfort entscheidend. Cal.com Workflows senden Bestätigungen und Anstöße zur richtigen Zeit, was Ihre Pipeline vorhersagbar hält und Ihr Team auf finanzierte Kredite konzentriert, anstatt die Teilnahme zu verfolgen.

03

eine moderne Kreditnehmererfahrung bieten

Bieten Sie einen polierten, zugänglichen Zeitplanungsprozess an, der maßgeschneidert und nicht allgemein gehalten ist. Mit gebrandeten Seiten, Zeitmanagement und intelligenter Weiterleitung können Kreditnehmer Beratungsgespräche zur Refinanzierung buchen, die in ihren Zeitplan passen. Fügen Sie Vorqualifikationsfragen hinzu, um Erwartungen festzulegen und aktuelle Zinssätze, Kreditsalden und Immobilieninformationen zu sammeln, damit jedes Meeting mit Kontext beginnt und mit klaren nächsten Schritten endet.

04

bauen Sie selbstbewusst mit offener Terminierungsinfrastruktur

Cal.com ist Open Source und API-first, sodass Kreditgeber und Fintech-Teams selbst hosten, die Terminplanung einbetten und sich in CRM-, LOS-Plattformen und interne Tools integrieren können. Erstellen Sie benutzerdefinierte Workflows für Offenlegungen, Bewertungskoordination und Nachbetreuungs-Check-ins. Sie kontrollieren die Datenresidenz und Berechtigungen, während Sie den Kreditvergabeoffizieren eine einfache, zuverlässige Terminplanungserfahrung bieten, die sich über Filialen und Partner hinweg skaliert.

Eingabeformulare mit intelligenter Routenführung

Erfassen Sie Informationen zu Eigentum, Kredit und Zielen und leiten Sie diese dann nach Lizenzierung, Sprachen, Produktanpassung oder SLA weiter. Reduzieren Sie die manuelle Sortierung und bringen Sie die Kreditnehmer schnell zum richtigen Experten.

Multikanal-Erinnerungen und -Checklisten

Email-, SMS- und WhatsApp-Erinnerungen reduzieren Versäumnisse. Hängen Sie Pre-Call-Checklisten, Bewertungsszenarien und erforderliche Dokumente an, um die Beratungen produktiv zu gestalten.

Round-Robin- und Prioritätszuweisung

Lasten Sie die Arbeitslasten der Darlehensnehmer aus, priorisieren Sie die besten Produzenten und respektieren Sie die Öffnungszeiten der Filialen. Konfigurieren Sie Besprechungspuffer, Mindestankündigungsfristen und Regeln zur Neuplanung.

konforme Selbsthosting

Self-hosten Sie Cal.com, um Daten in Ihrer Umgebung zu behalten. Granulare Rollen, Prüfprotokollierung und SSO unterstützen die Anforderungen an die Einhaltung von Kreditgebervorschriften.

tiefe Integrationen und Webhooks

Verbinden Sie Ihr CRM und LOS, lösen Sie Webhooks nach Buchungen aus und synchronisieren Sie Ergebnisse mit Slack oder internen Systemen, um Dateien von der Beratung zur Underwriting zu verschieben.

Gruppen-, Telefon- oder Video-Konsultationen

Angebot in der Filiale, Telefon- oder Video-Meetings. Automatisch sichere Videolinks generieren und Co-Moderatoren wie Bearbeiter oder Immobilienpartner hinzufügen, wenn erforderlich.

Beginnen Sie mit der automatisierten Refinanzierungsplanung

Starten Sie kostenlos oder sprechen Sie mit unserem Team über Arbeitsabläufe für Ihre Branche, Ihr Callcenter oder Fintech. Richten Sie Routing, Erinnerungen und Nachverfolgungen ein, die No-Shows reduzieren und Abschlüsse beschleunigen. Wenn Sie bereit sind, Refinanzierungsberatungen skalierbar zu machen, ohne manuelle Arbeit hinzuzufügen, erstellen Sie noch heute Ihr Konto oder fordern Sie eine Demo an.