01

Collega i tuoi calendari e imposta i tipi di eventi di prestito

Crea link di prenotazione per chiamate di prequalificazione, consultazioni di mutui e aggiornamenti di sottoscrizione. Sincronizza i calendari Google, Microsoft o Cal.com per evitare doppie prenotazioni in tutto il tuo team.

02

Aggiungi instradamento intelligente e domande di screening

Instrada i mutuatari in base all'interesse del prodotto come FHA, VA o convenzionale, posizione della filiale, lingua o profilo di credito. Raccogli i dettagli richiesti in anticipo affinché il tuo specialista del prestito FHA o l'ufficiale del prestito VA veda il contesto immediatamente.

03

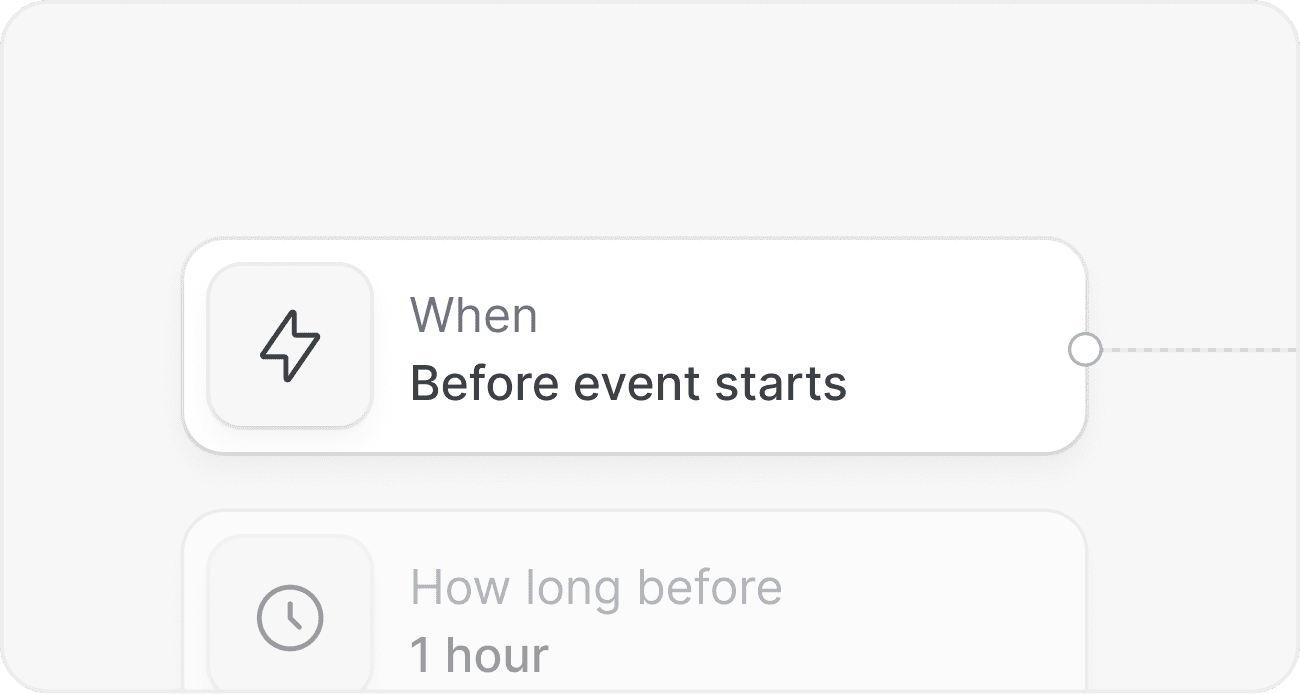

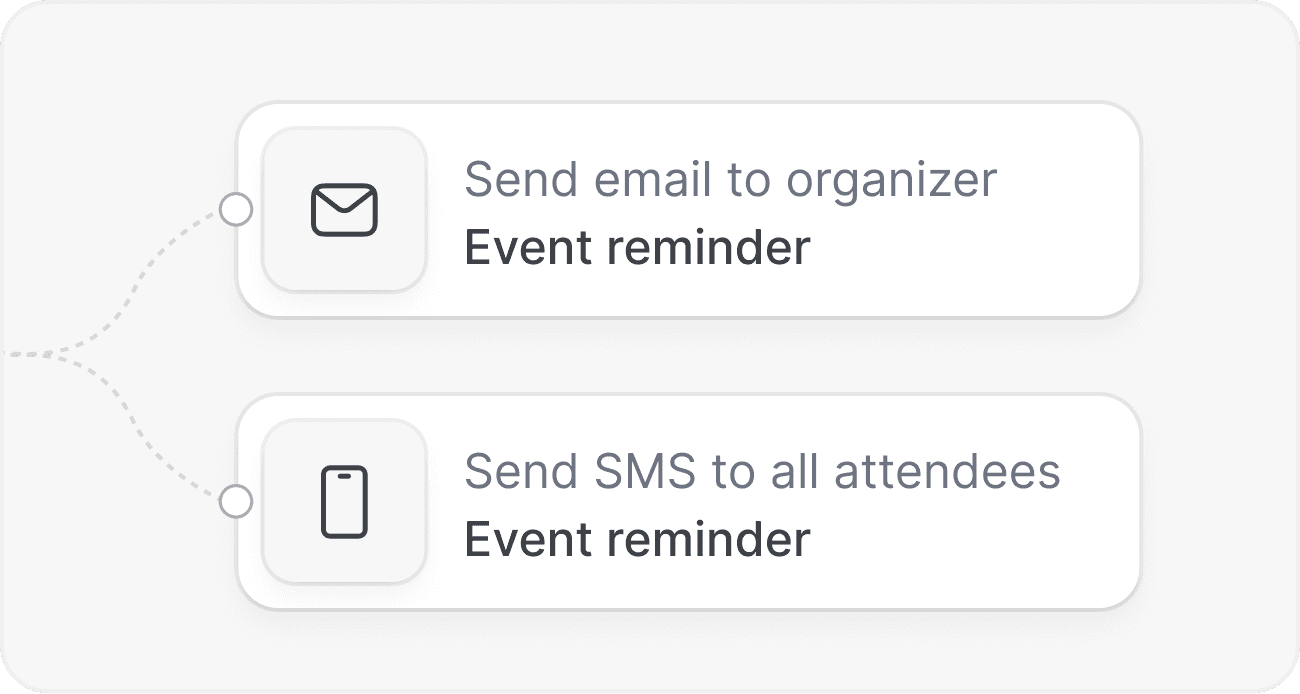

Automatizza promemoria e follow-up

Invia email, SMS o promemoria WhatsApp per documenti, preparazione di valutazioni e scadenze per il blocco dei tassi. Attiva aggiornamenti di stato dopo gli incontri ed escalare i mutuatari che non rispondono a un manager.

01

Riduci il tempo fino al primo colloquio

Riduci l'attrito nella parte superiore del funnel. Consenti ai potenziali clienti di prenotare un appuntamento con un consulente per prestiti ipotecari in pochi secondi dal tuo sito web, email CRM o codice QR, con rilevamento istantaneo del fuso orario e sincronizzazione del calendario.

02

Migliora la conversione con il routing basato sul prodotto

Abbina i mutuatari allo specialista di prestiti FHA o all'ufficiale dei prestiti VA migliore disponibile in base all'intenzione e all'idoneità. Distribuisci equamente i contatti, riduci i tempi di attesa e aumenta i tassi di prestito finanziati.

03

Elimina le assenze e documenta i ritardi

I promemoria automatizzati aiutano i mutuatari ad arrivare preparati, a inviare le buste paga e gli estratti conto bancari in tempo e a mantenere il processo di sottoscrizione in movimento. Meno riprogrammazioni, tempi di ciclo più ridotti, clienti più felici.

04

Rimani conforme e pronto per l'impresa

Utilizza registri audit-friendly, accesso basato sui ruoli e opzioni di auto-ospedalizzazione. Cal.com è open source con SSO, SCIM, permessi granulari e conservazione configurabile per allinearsi alla supervisione ipotecaria.

Routing di moduli e rotazione a turni del team

Fai domande di qualificazione, quindi indirizza al funzionario o al pool giusto. Bilancia i carichi di lavoro con regole di priorità e disponibilità che proteggono gli SLA.

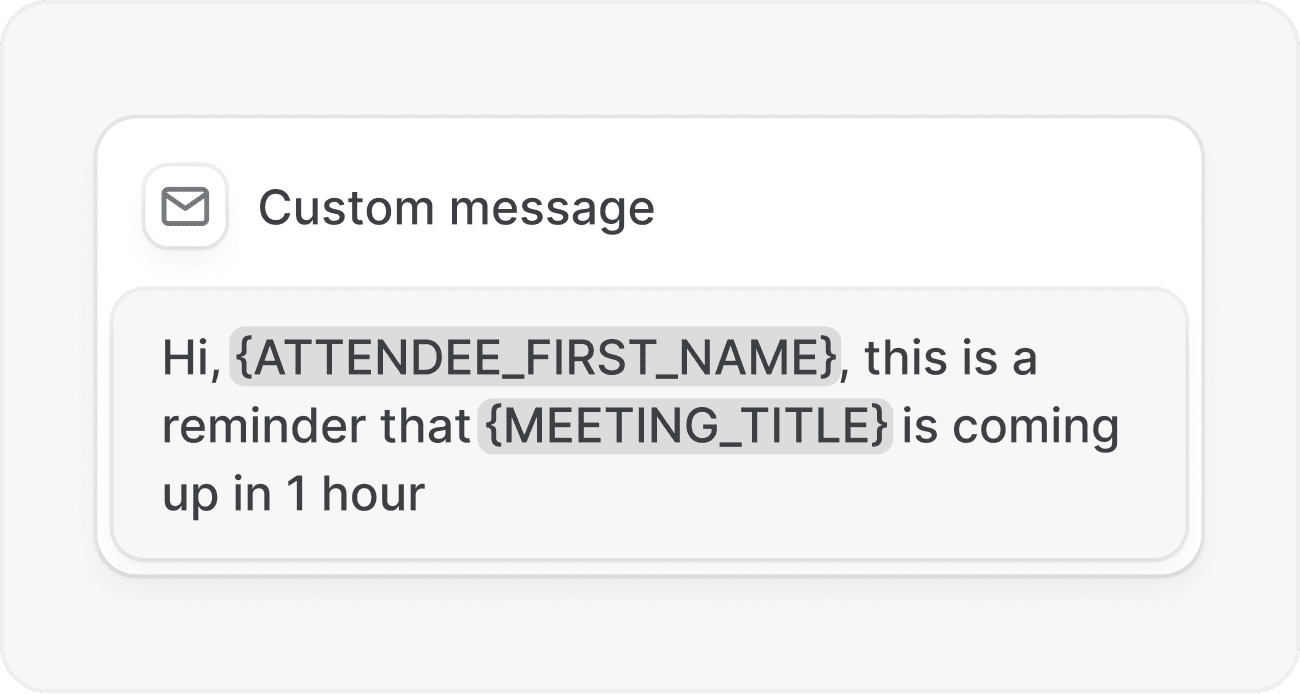

Notifiche multicanale

Invia conferme, promemoria e follow-up tramite email, SMS o WhatsApp. Personalizza i tempi per le scadenze dei documenti, le divulgazioni e le finestre di valutazione.

Pianificazione di gruppi e pannelli

Coordinare il mutuatario, il co-mutuatario, l'agente immobiliare e l'ufficiale del prestito in un unico link. Aggiungere elaboratori o sottofaccendieri quando necessario senza la necessità di comunicazioni manuali.

Opzioni open source e self-hosting

Distribuisci sulla tua infrastruttura per soddisfare le esigenze di sicurezza e residenza dei dati. Trasparenza del codice sorgente completo ed estensibilità supportata dalla comunità.

API prima e webhook

Crea prenotazioni, gestisci flussi di lavoro e pubblica aggiornamenti di stato nel tuo LOS o nel tuo data warehouse. Attiva webhook su prenotazioni, riprogrammazioni e cancellazioni.

Integrazioni che si adattano al tuo stack

Collega i calendari di Google e Microsoft, Slack, Zoom, Teams e altro ancora. Usa Zapier o API native per aggiornare i sistemi CRM e di marketing dopo ogni evento.

Come aiuta Cal.com un ufficiale di prestito ipotecario a gestire le consultazioni?

Offri un unico link di prenotazione per i tipi di consulenza sui prestiti per la casa, indirizza automaticamente agli specialisti e invia le checklist di preparazione. I calendari rimangono sincronizzati, i promemoria riducono le assenze e le note fluiscono ai tuoi sistemi tramite API.

Posso indirizzare i mutuatari a uno specialista di prestiti FHA o a un funzionario di prestiti VA?

Sì. Crea moduli di routing che rilevano l'interesse o l'idoneità del prodotto, quindi instrada a uno specialista FHA o VA, a un team di filiale o al funzionario disponibile successivo in base alle regole che controlli.

Come gestiscono i promemoria le scadenze per la raccolta dei documenti?

Imposta i flussi di lavoro basati sul tempo per sollecitare i mutuatari per documenti reddituali, estratti conto bancari o firme elettroniche. Escalate dopo la mancata risposta e invia messaggi diversi ai co-mutuatari o agli agenti.

Cal.com supporta le esigenze di conformità e sicurezza per i prestatori?

Sì. L'accesso basato sui ruoli, i registri di audit, la SSO, SCIM, le liste di indirizzi IP consentiti, l'auto-ospedale e la retention configurabile aiutano ad allinearsi con i requisiti di sicurezza e di supervisione dei prestatori.

Posso coordinare incontri con i mutuatari e i realtor insieme?

Usa eventi di gruppo per includere mutuatari, co-mutuatari, agenti immobiliari e il tuo team. Tutti ricevono automaticamente il giusto link per unirsi, la posizione e i promemoria.

Come funziona questo con il nostro CRM e LOS?

Utilizza l'API e i webhook per creare attività, aggiornare gli stati dei lead e inviare i risultati delle riunioni al tuo CRM e LOS. Zapier e le integrazioni native coprono i flussi di lavoro comuni.

C'è supporto per filiali e team in più sedi?

Sì. Crea modelli a livello organizzativo, applica il branding e le politiche e utilizza pool round robin per filiale. Le analisi ti aiutano a monitorare l'utilizzo e i tempi di risposta.

Inizia più velocemente, chiudi prima

Offri ai mutuatari un modo semplice per programmare con l'esperto giusto. Prova Cal.com gratuitamente o parla con il nostro team di distribuzione open source, instradamento avanzato e integrazioni API personalizzate per il tuo flusso di lavoro ipotecario.