01

Collect and qualify inquiries

Embed booking on your site and route by location, availability, or program. Capture consent, income, and goals, then auto-assign the right counselor or nonprofit credit counseling partner.

02

Automate intakes and document prep

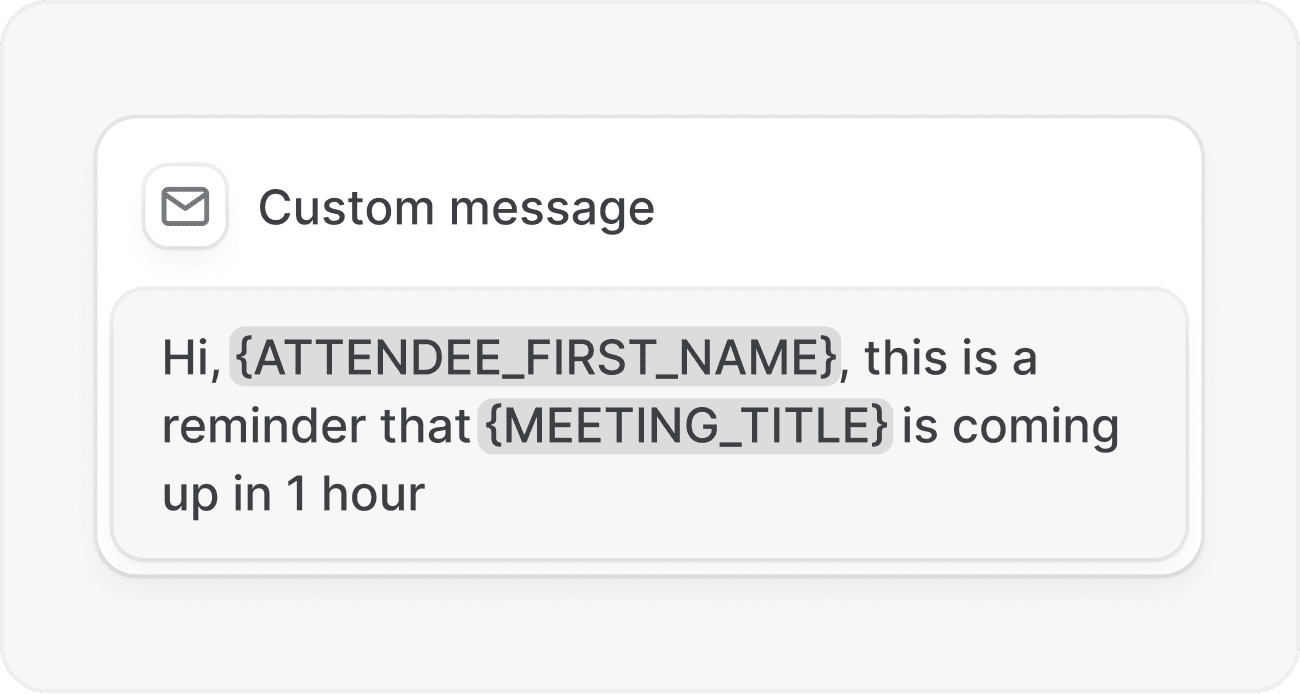

Trigger reminders for pay stubs, creditor lists, and budgets. Send SMS or email nudges, pre-meeting questionnaires, and calendar invites to cut no-shows and speed debt management plan readiness.

03

Track plans and follow-ups

Schedule recurring check-ins, payment milestones, and hardship reviews. Push updates to CRM, notify teams in Slack, and send clients plain-language summaries after each session.

01

Fewer no-shows, faster first appointments

Make it easy for clients searching for credit counseling near me to book the right time in seconds. Automated confirmations and multi-channel reminders reduce missed sessions and last-minute cancellations. Intake questions collect financial context upfront, so counselors spend more time advising and less time chasing paperwork. Clients receive clear instructions and options for phone, video, or in-person appointments, all synced to their calendars. Routing rules instantly match inquiries to the right specialist based on location, language, availability, or program eligibility. The result is a dependable first visit that starts on time and sets a collaborative tone for the journey ahead.

02

Streamlined intakes for complex financial cases

Turn fragmented intake steps into a guided, automated flow. Use pre-meeting questionnaires to gather income, expenses, creditor lists, and goals, accelerating debt management plan assessments. Automated reminders prompt clients to upload required documents before their appointment, improving completion rates. Nonprofit credit counseling teams can standardize workflows across branches while preserving local flexibility. After each session, trigger follow-ups to confirm action items, share budgeting resources, and schedule check-ins. These automations reduce administrative back-and-forth, help counselors prepare efficiently, and give clients a clear path to progress.

03

Compliance, privacy, and audit readiness

Protect sensitive financial data with enterprise-grade controls. Cal.com supports SOC 2 Type II and GDPR readiness, granular consent collection, access controls, and audit logs. Configure data retention policies, custom disclosures, and secure file collection to meet program and funder requirements. Self-hosting options let your organization keep data within your own infrastructure while maintaining the same powerful scheduling features. Standardized, auditable workflows help teams demonstrate consistent, fair client treatment and deliver transparent documentation for quality reviews and compliance checks without slowing down day-to-day operations.

04

Built for teams, open to developers

Equip staff, volunteers, and partner agencies with a unified scheduling layer that integrates with your systems. Cal.com is open source and API-first, so you can tailor flows for counseling, group workshops, or creditor calls. Connect CRM, telephony, and messaging tools to reduce context switching. If clients ask about credit repair vs counseling, build educational touchpoints into confirmations and reminders to set expectations early. Offer SSO for staff, role-based permissions for supervisors, and routing forms that scale across programs. With developer-ready webhooks, you can automate downstream tasks the moment a booking or update occurs.

Routing forms and rules

Qualify clients with custom forms, then route by program, location, language, counselor availability, or funding source. Balance workloads automatically and ensure every inquiry lands with the best-fit counselor.

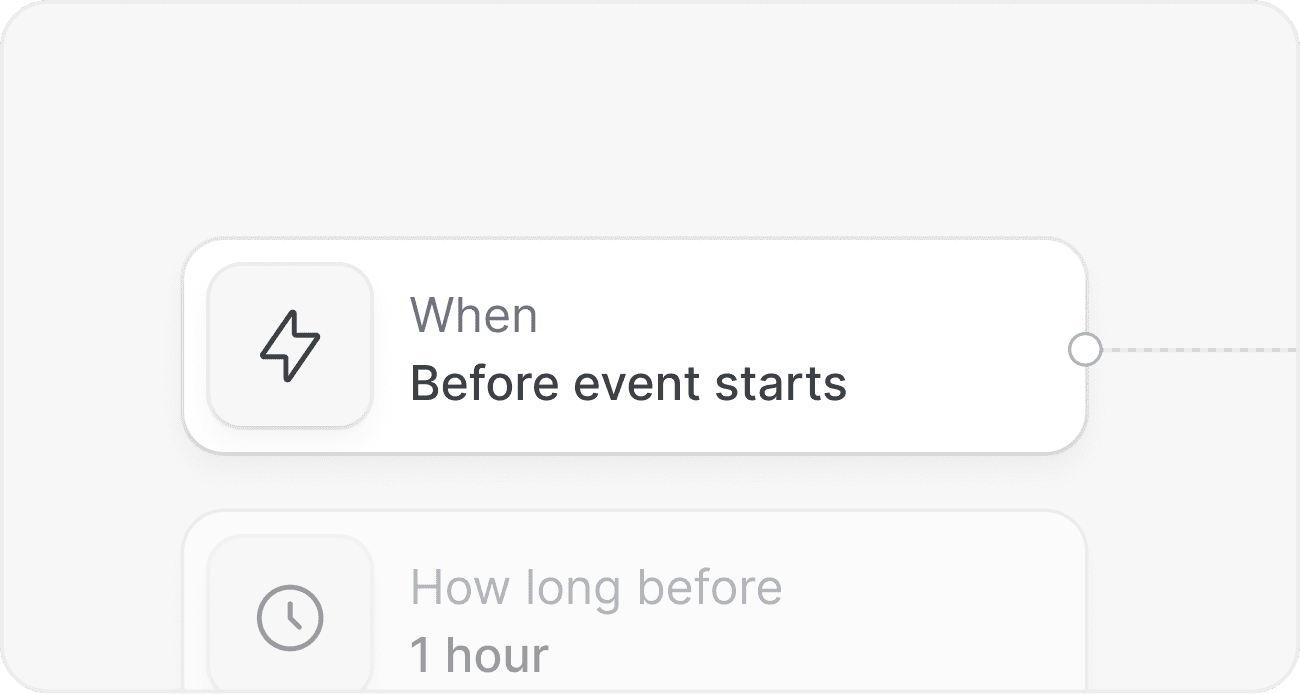

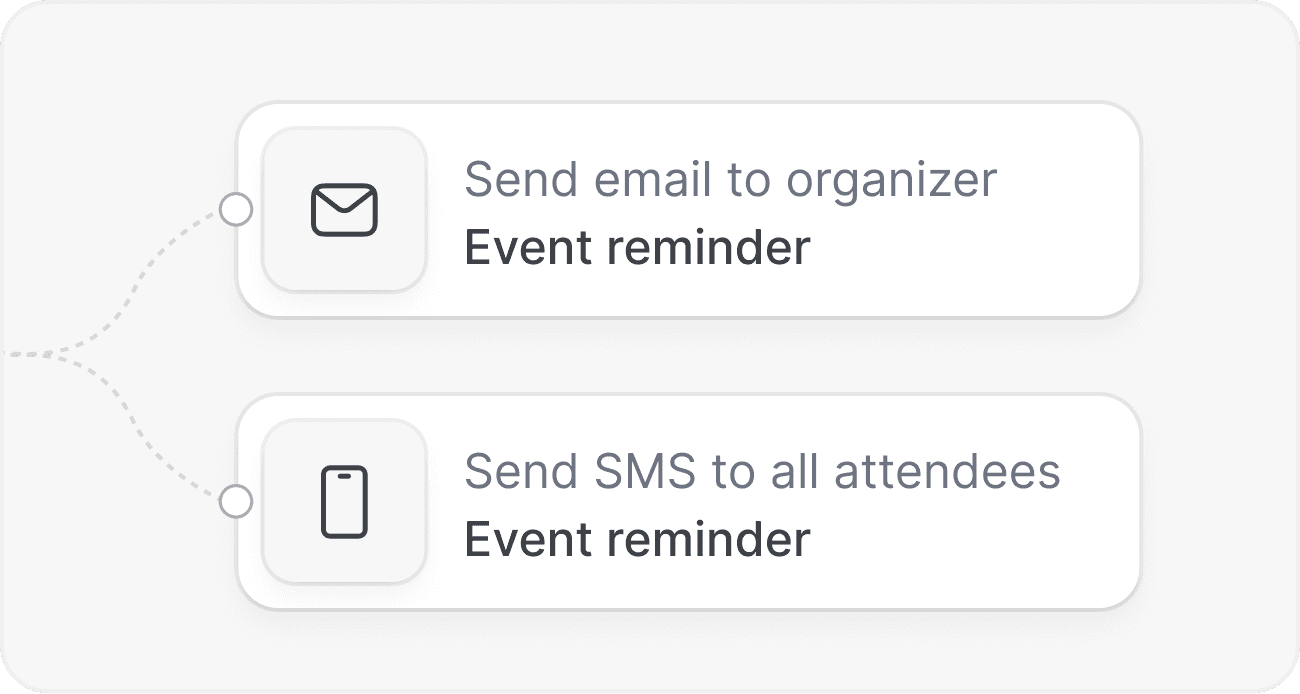

Multi-channel reminders

Reduce no-shows with email, SMS, and WhatsApp reminders. Configure timing for 24 hours and same-day, include preparation checklists, and send follow-ups after sessions with clear next steps.

Secure file and data collection

Collect required intake details and files with consent. Restrict access by role, use audit logs, and configure retention to align with policy. Self-host to keep data within your own environment.

CRM and communications integrations

Sync bookings, attendance, and notes to your CRM. Notify teams in Slack, post-call summaries via email, and keep calendars in Google, Outlook, or iCloud aligned across staff and volunteers.

Self-hosted and SSO options

Deploy Cal.com on your infrastructure for maximum control. Offer SSO and role-based permissions, standardize templates across branches, and maintain consistent, compliant client experiences.

Developer API and webhooks

Use our API to create events, manage workflows, and update records programmatically. Fire webhooks on bookings, reschedules, and cancellations to trigger downstream tasks and reporting.

Ready to modernize your counseling workflows?

Start with a free account or book a short demo to see Cal.com in action for credit counseling. Automate intakes, reminders, and plan check-ins, so your team can focus on client outcomes.