01

Conecte os seus calendários e disponibilidades

Sincronize os calendários do Google, Outlook ou CalDAV, defina a disponibilidade da equipe de empréstimos e evite reservas duplicadas para que cada consulta e acompanhamento de hipoteca se encaixem no seu pipeline sem conflitos.

02

Construa o seu fluxo de trabalho de mutuário

Criar formulários de admissão, lógica de qualificação e lembretes para o processo de pré-aprovação de hypoteca. Roteie os mutuários para o corretor de empréstimos habitacionais ou corretor de refinanciamento certo automaticamente.

03

Lançar, acompanhar e otimizar

Incorpore a reserva no seu site, partilhe links e monitore a conversão. Utilize fluxos de trabalho para ativar lembretes, divulgações e tarefas pós-reunião que mantenham os ficheiros em movimento.

01

Converter mais leads que procuram corretor de hipotecas perto de mim

Conheça os mutuários no momento em que estão prontos. Incorpore a reserva instantânea em páginas de aterragem que capturam tráfego de pesquisas como corretor de hipotecas perto de mim e os melhores corretores de hipotecas. Direcione por tipo de empréstimo, idioma ou agência, e depois automatize confirmações e lembretes para aumentar as taxas de apresentação. Com uma experiência de marca e reservas móveis amigáveis, você reduz a fricção, constrói confiança e converte mais primeiros contatos em empréstimos financiados.

02

Acelere o processo de pré-aprovação do empréstimo hipotecário

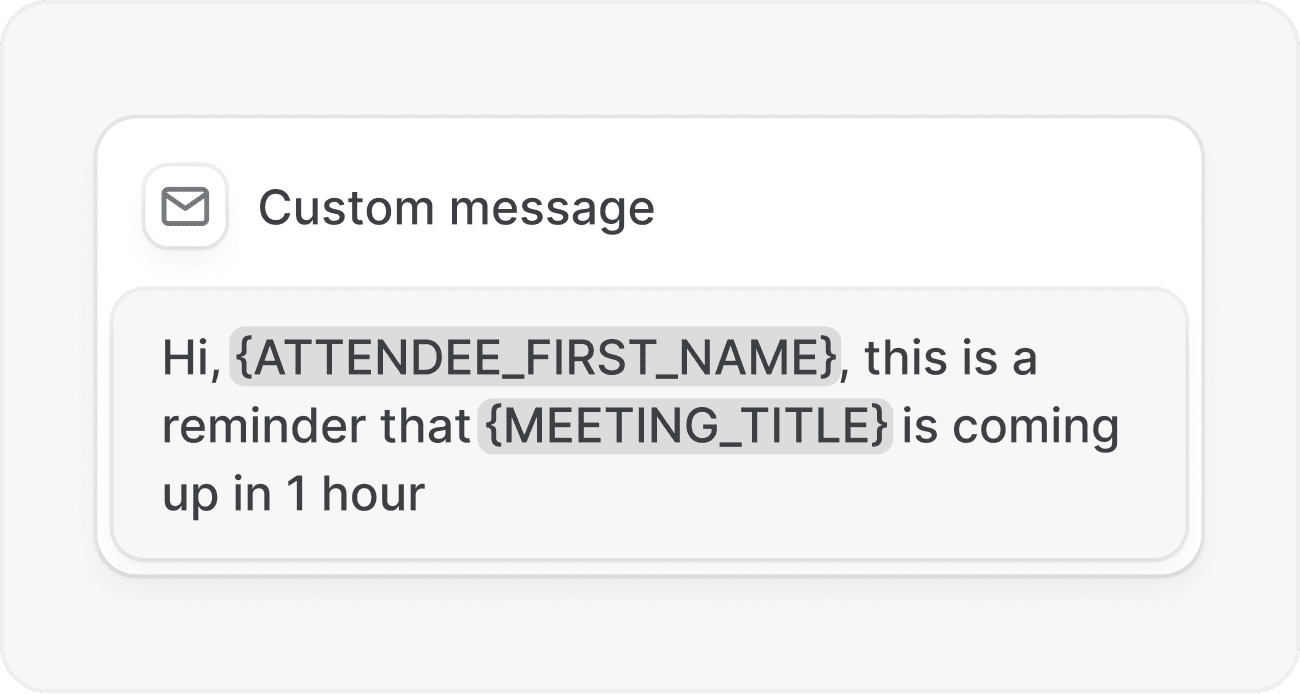

Substitua a etiqueta de telefone por agendamento guiado e formulários inteligentes. Colete detalhes sobre rendimento, propriedades e prazos antes da chamada, e depois desencadeie pedidos de documentos por email ou tarefas logo após a reunião. Lembretes automatizados através de email, SMS e WhatsApp mantêm os mutuários envolvidos, reduzem idas e vindas, e ajudam os oficiais de crédito a passar do lead para a carta de pré-aprovação mais rapidamente com menos etapas manuais.

03

Ofereça a cada mutuário uma experiência de luva branca em grande escala

Crie comunicações consistentes e em conformidade para jornadas de compra e refinanciamento. Defina lembretes personalizados para avaliações, divulgações e prazos de bloqueio de taxas. Envie atualizações com a marca que tornam até mesmo etapas complexas simples. Quer seja um corretor de empréstimos para habitação a trabalhar sozinho ou parte de uma equipa de múltiplas filiais, os fluxos de trabalho ajudam-no a oferecer a mesma experiência fiável todas as vezes.

04

Operar com segurança com flexibilidade de nível empresarial

O Cal.com é open source e API first, com a opção de auto-hospedagem. Integre com LOS, CRM e ferramentas de dados, reforçe o acesso baseado em funções e registre cada ação para auditorias. Os desenvolvedores podem estender fluxos de trabalho com webhooks para atualizar marcos ou acionar tarefas de subscrição, enquanto os administradores mantêm controle sobre modelos, consentimento e configurações de retenção.

Formulários de roteamento e sistema round robin

Qualifique por estágio de crédito, tipo de empréstimo ou região, e depois encaminhe automaticamente para o oficial de empréstimos certo. Equilibre as cargas de trabalho com atribuição em sistema de rodízio ou com base em prioridade.

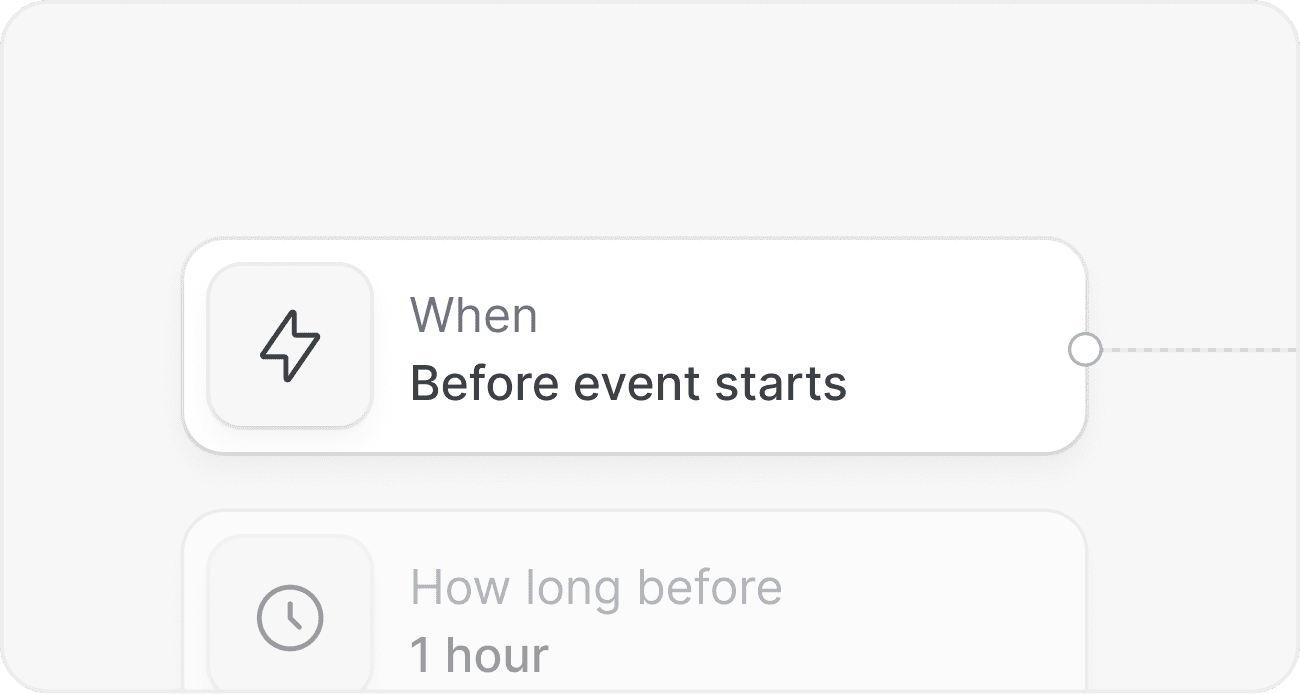

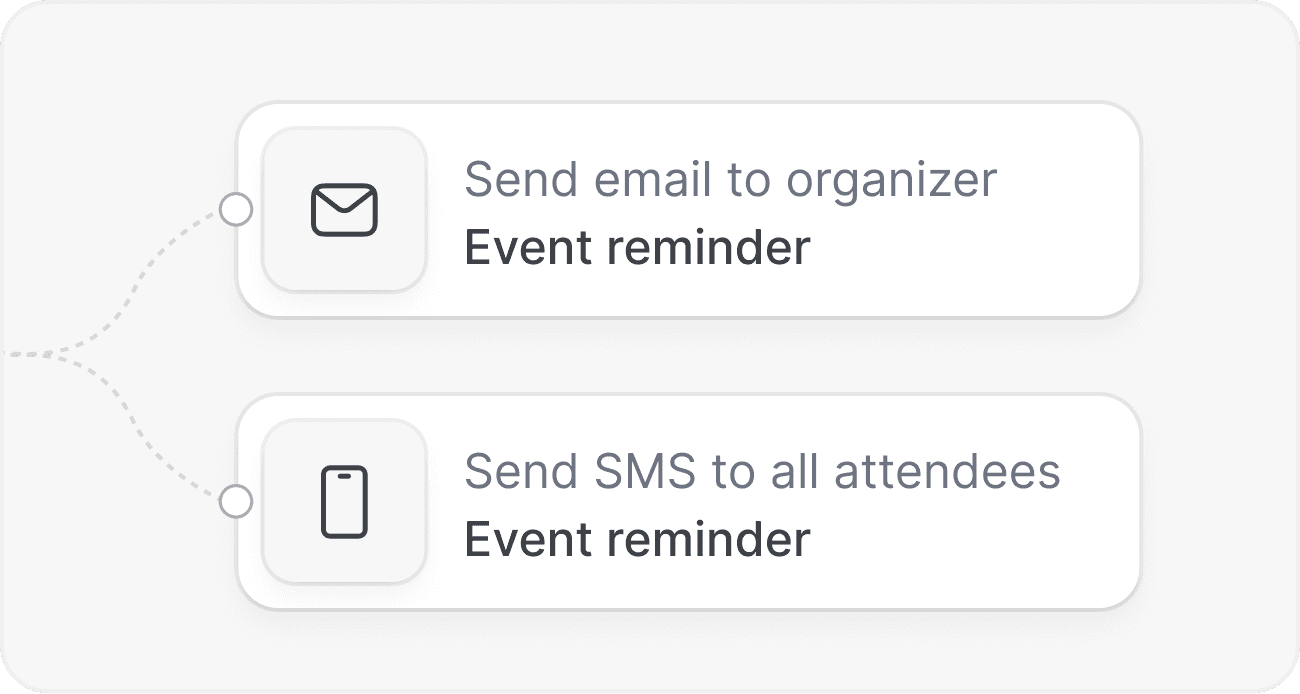

Lembretes multicanal

Reduza as faltas com lembretes por e-mail, SMS e WhatsApp. Personalize o tempo para as primeiras consultas, verificação de processadores e encerramento de compromissos.

Aquisições e divulgações de marca

Coletar detalhes pré-reunião com campos personalizados. Incluir NMLS, Igualdade de Habitação e divulgações estaduais em confirmações para uma experiência de mutuário em conformidade.

Incorporações e ligações em qualquer lugar

Incorpore a programação em páginas de destino, formulários de captura de leads e portais de parceiros. Compartilhe um link para consultas de compra, refinanciamento ou HELOC.

API e webhooks amigáveis para desenvolvedores

Conecte a Cal.com ao seu CRM ou LOS. Acione tarefas, atualize fases de negócios ou envie documentos quando os eventos forem marcados, reagendados ou concluídos.

Auto-hospedagem e permissões granulares

Implante na sua infraestrutura para ter o controle total. Utilize SSO, SCIM e acesso baseado em funções para proteger dados sensíveis dos mutuários e configurações da equipe.

Como é que os fluxos de trabalho ajudam o processo de pré-aprovação do empréstimo hipotecário?

Os fluxos de trabalho reúnem informações essenciais do mutuário antes da chamada, encaminham para o oficial de crédito certo e enviam lembretes e seguimentos automaticamente. Após as reuniões, podem acionar pedidos de documentos e atualizações de status.

Posso encaminhar leads para o melhor agente de crédito por tipo de empréstimo ou filial?

Sim. Utilize formulários de encaminhamento e regras para atribuir consultas de compra, refinanciamento ou HELOC por especialização, filial, idioma ou disponibilidade. O encaminhamento por sorteio e prioridade é suportado.

Os lembretes suportam SMS para mutuários em movimento?

Sim. Envie emails, SMS e lembretes via WhatsApp. Você controla o timing, a frequência e o conteúdo para reduzir ausências e manter os mutuários envolvidos durante todo o processo.

A Cal.com pode integrar-se com o nosso CRM e LOS?

Cal.com é API em primeiro lugar e suporta webhooks. As equipas geralmente conectam CRMs e ferramentas de subscrição para atualizar estágios, criar tarefas e registrar reuniões automaticamente.

A auto-hospedagem está disponível para conformidade e controle de dados?

Sim. Pode hospedar Cal.com por conta própria para atender a necessidades rigorosas de segurança e conformidade, enquanto mantém total paridade de recursos para fluxos de trabalho e agendamento.

Como é que apoia equipas de muitos agentes de crédito?

Utilize páginas de equipa, rodízio e disponibilidade agrupada. Os administradores gerem modelos, permissões e marcas para que cada mutuário receba uma experiência consistente.

Posso usar o Cal.com se for um corretor de empréstimos habitacionais independente?

Absolutamente. Corretores independentes podem lançar uma página de reservas simples, automatizar lembretes e crescer com roteamento avançado e integrações quando necessário.

Comece com os fluxos de trabalho de hipoteca

Automatize consultas, lembretes e acompanhamentos para que a sua equipa feche mais empréstimos com menos esforço. Comece gratuitamente, explore a API ou solicite uma demonstração personalizada para ver como Cal.com se encaixa na sua operação.