01

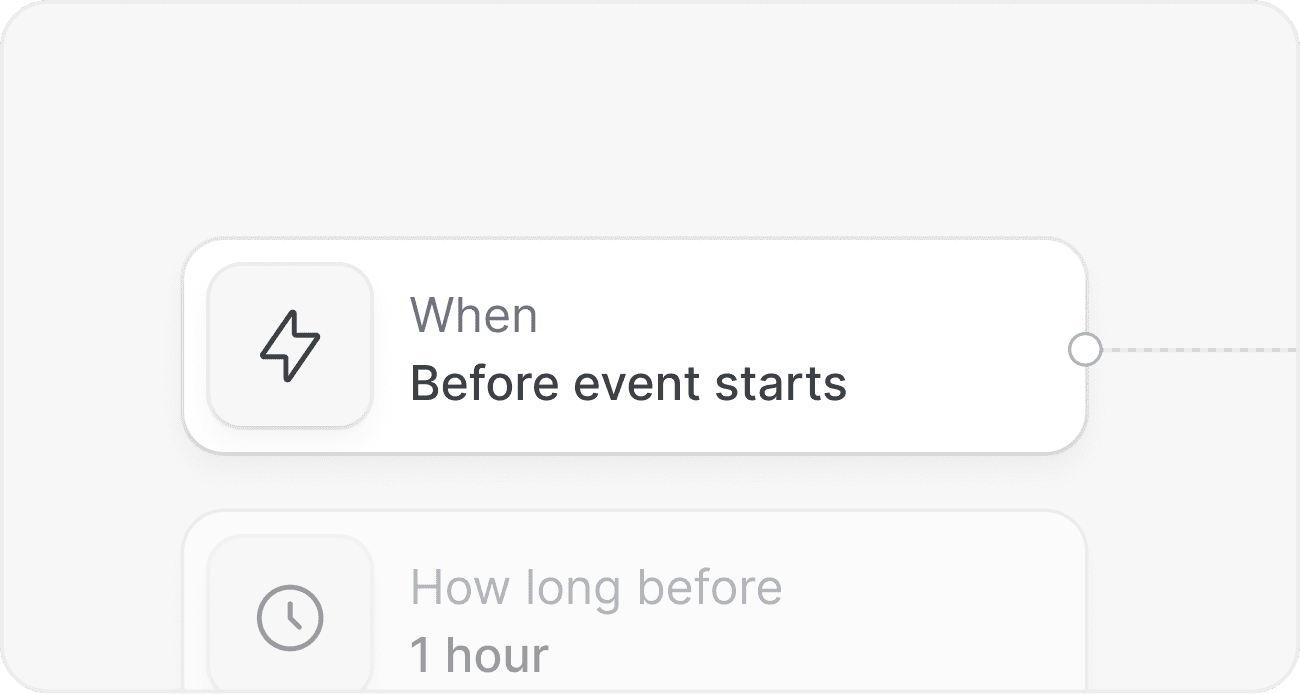

Define triggers for key milestones

Start by mapping your accounting lifecycle, from new client intake to monthly close and tax filings. In Cal.com, choose the trigger that kicks things off, such as when a meeting is booked, a client reschedules, or a due date approaches. For tax engagements, trigger reminders 14 days before a filing deadline, then again 24 hours before. For controllership work, trigger tasks around your month end close checklist at T minus 3 days and on day 1. You can also start workflows when a routing or intake form is submitted for accounting client onboarding. Connect practice tools using webhooks or Zapier so every booking updates your CRM and task manager. Explore setup details at https://cal.com/workflows.

02

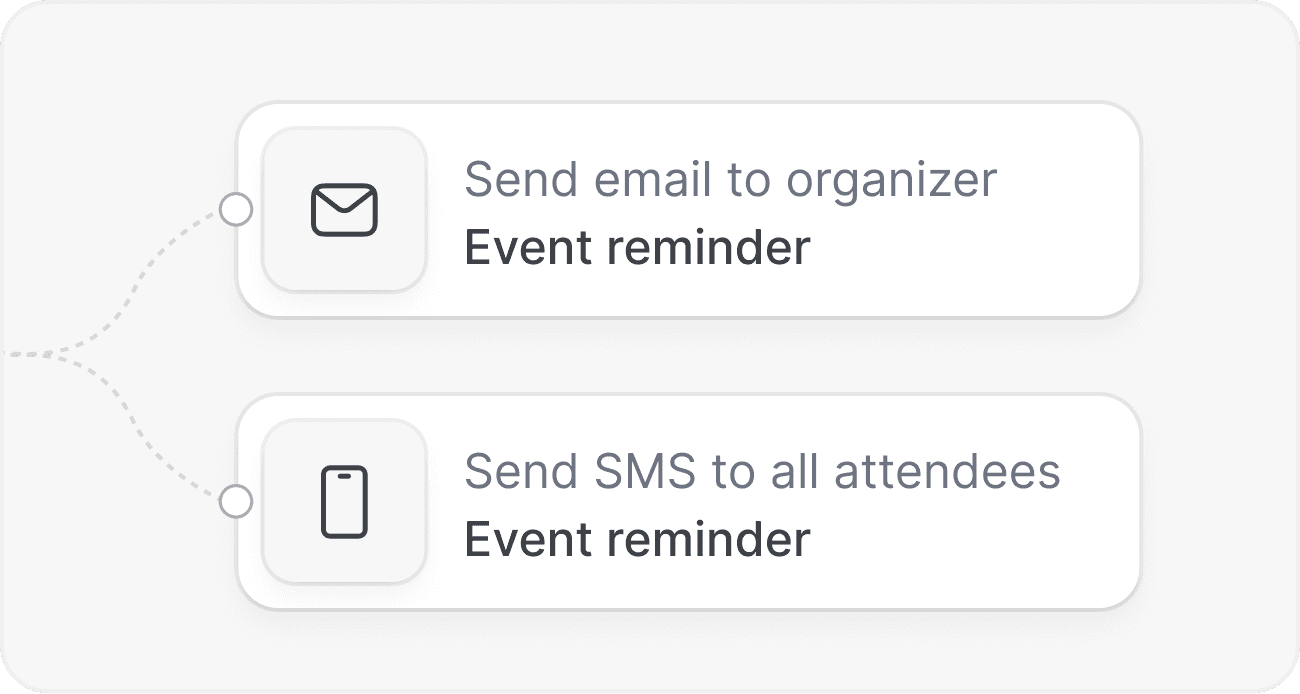

Automate messages and tasks

Choose the actions that should happen next. Send email, SMS, or WhatsApp reminders with prep instructions, links to your secure portal, and the exact documents you need. Ask clients to complete a tax preparation checklist or upload accounting workpapers before the meeting. Notify your team in Slack, post to a reconciliation channel, or create a task in your practice system via Zapier. After the meeting, send follow ups with next steps and a link to schedule the next check in. Tie each message to a consistent bookkeeping workflow so nothing is missed. See integrations at https://cal.com/integrations.

03

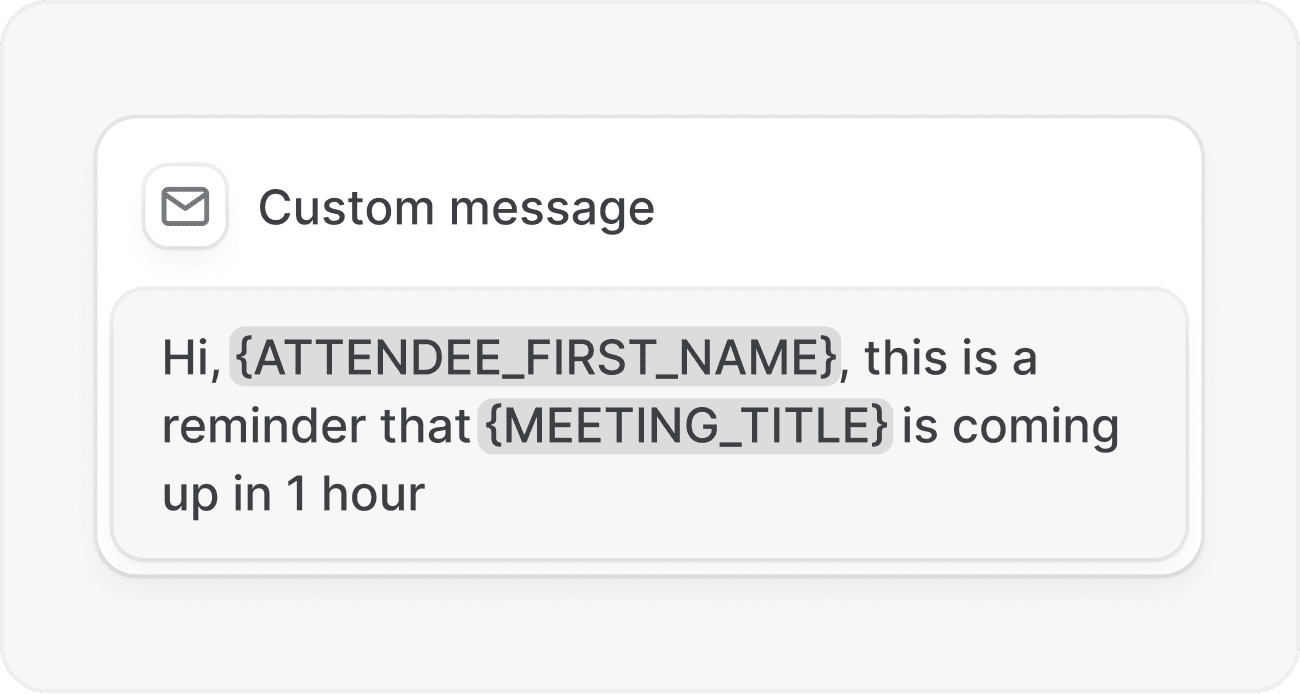

Personalize scheduling for clients and teams

Personalize messaging with variables like client name, service type, organizer, and time zone. Route bookings to the right partner or staff accountant using forms and team round robin. Use group events when multiple stakeholders must attend, such as kickoff calls or audit fieldwork. For onboarding, automatically schedule chart of accounts setup and training sessions. Create role based messages so clients, partners, and staff receive the right instructions at the right time. Developers can manage workflows programmatically with our API at https://docs.cal.com/api. If you need full control of data residency, deploy Cal.com self hosted from https://github.com/calcom.

01

Fewer no-shows and last minute delays

Automated reminders across email, SMS, and WhatsApp keep clients informed and on time. Pre event messages include directions, portal links, and prep items so meetings start ready. You can add confirmations and nudges that escalate as a due date approaches, which reduces missed appointments during tax season and monthly close. The result is a predictable calendar and fewer urgent reschedules for your team.

02

Operational consistency across every engagement

Codify your firm’s best practices once, then apply them to every client. Use workflows to enforce consistent steps for accounting client onboarding, chart of accounts setup, quarterly reviews, and your month end close checklist. For tax season, attach the same tax preparation checklist to each booking so staff and clients know exactly what is required. Standardization lowers training time and helps new hires execute with confidence.

03

Developer friendly and enterprise ready

Cal.com is open source and API first, which means you can integrate scheduling deeply with your practice systems. Use webhooks to update records, add audit trails, and orchestrate tasks. Self host if you need tighter control and customize the code for unique workflows. Role based permissions and detailed event logs support firm wide governance. Read the docs at https://docs.cal.com.

04

Works with your accounting stack

Connect your calendars and communications in minutes. Cal.com integrates with Google and Microsoft calendars, Slack, Zoom, and Zapier, so you can plug into your practice tools without disruption. Trigger work in QuickBooks Online or Xero through Zapier or custom API calls. Whether you run a boutique firm or a multi office practice, workflows adapt to your bookkeeping workflow and advisory services. Browse integrations at https://cal.com/integrations.

Multi-channel reminders and follow ups

Send confirmations, reminders, and post meeting notes by email, SMS, or WhatsApp. Increase attendance and reduce back and forth for every client touchpoint. Use branded templates to keep communication consistent.

Conditional logic and timing controls

Trigger on booking, reschedule, cancellation, or time based offsets before or after a meeting. Sequence messages to suit each engagement. Delay or skip steps based on answers from routing forms or event type.

Routing forms and intake

Collect the right details upfront, then route clients by entity type, service, or urgency. Perfect for accounting client onboarding. Eliminate back and forth by capturing meeting goals and required systems upfront.

Group events and role based messages

Invite multiple stakeholders and tailor content for each role, for example client, partner, and staff accountant. Keep internal notes private while clients only see what they need to prepare.

Team scheduling and round robin

Balance workload across your team, set availability by service, and respect time zones for remote offices. Offer pooled availability for shared services like tax reviews or onboarding.

Secure self hosting and API access

Run Cal.com on your own infrastructure or use the hosted cloud. Extend workflows with webhooks and our API at https://docs.cal.com/api. Authenticate with API keys and manage workflows through code or the dashboard.

Automate your accounting scheduling today

Start free at https://cal.com/signup or book a demo at https://cal.com/contact/sales. In minutes, connect calendars, import event types, and build a workflow that aligns with your month end close checklist and tax engagements. Reduce no-shows, standardize client onboarding, and free up billable hours across your firm. Developers can extend everything with our API at https://docs.cal.com/api.