01

Connect your calendars and define your pipeline

Sync calendars, map stages in your mortgage advisor process flow, and set guardrails for availability, buffers, and required fields across loan types.

02

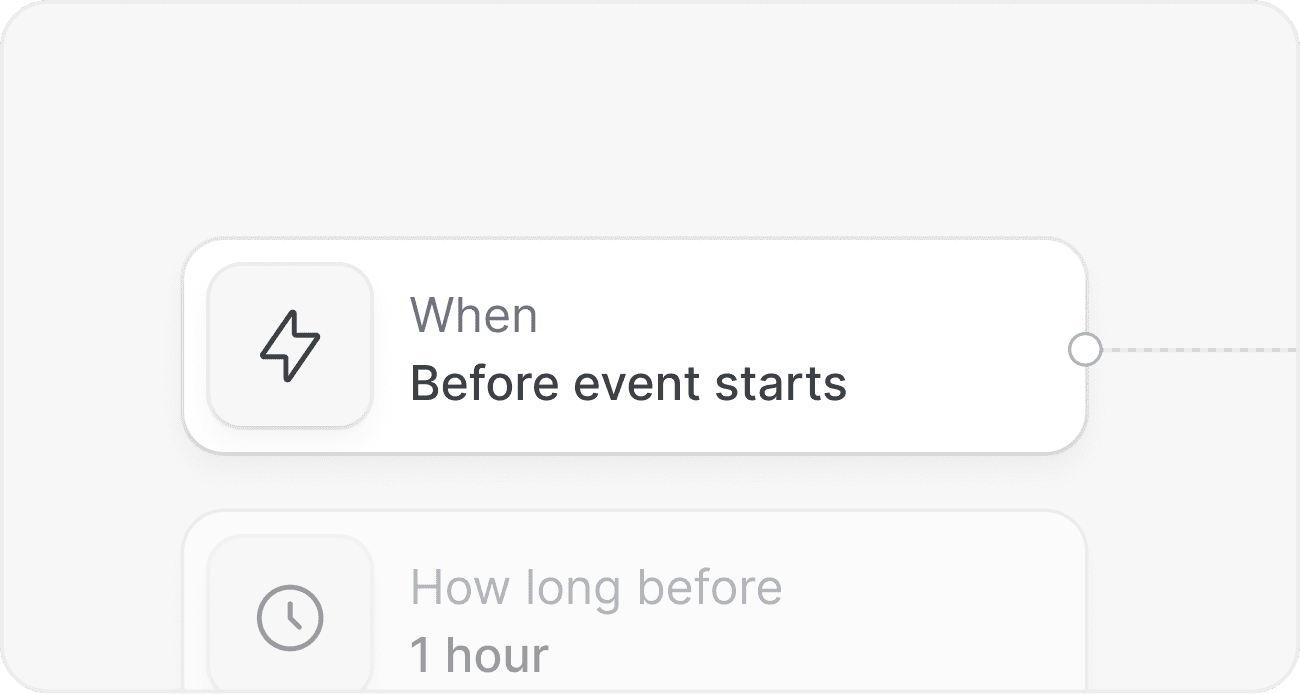

Choose triggers across the loan lifecycle

Use event-based or time-based triggers tied to key loan origination workflow steps, like pre approval, appraisal, underwriting, and closing to send timely prompts.

03

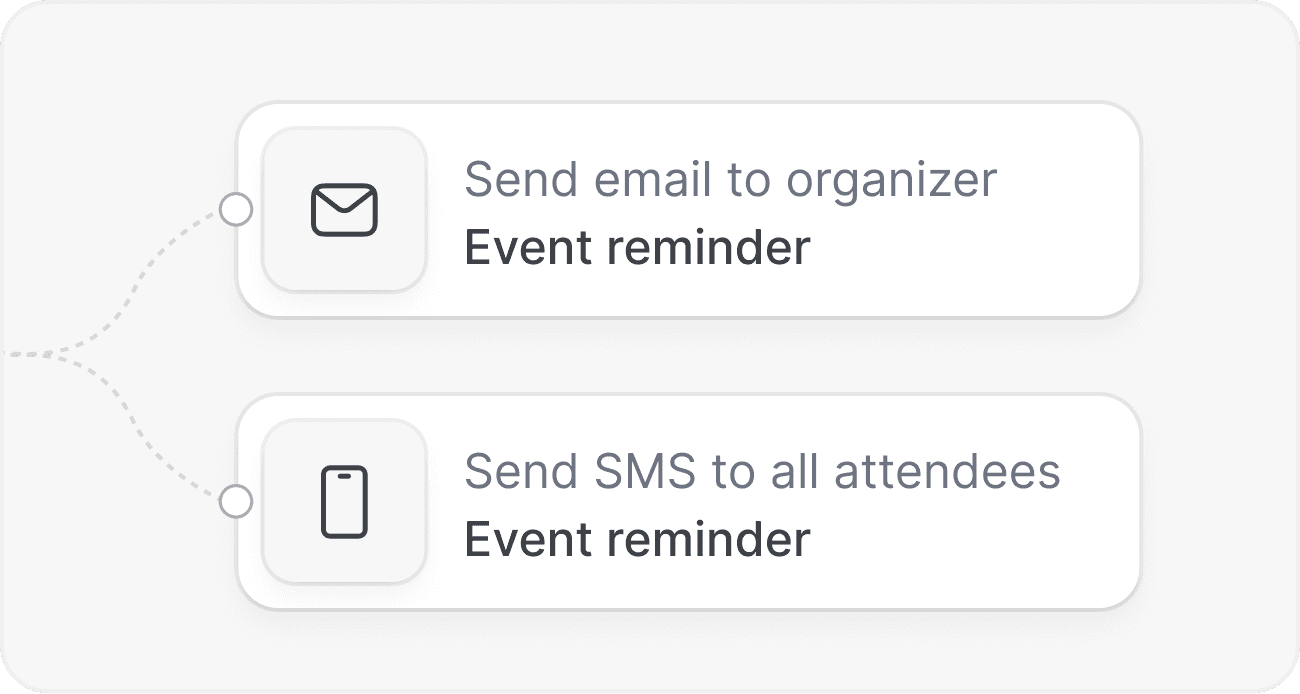

Automate messages, tasks, and handoffs

Send reminders, collect documents, route to teammates, and post updates to CRMs. Build consistent client touchpoints without manual follow up.

01

Convert more leads with timely, personal outreach

Turn inquiries into consultations with automated confirmations, reminders, and rescheduling. Embed booking in your site and email sequences to support mortgage lead nurturing tactics. Use routing and intake to qualify borrowers, capture goals, and steer them to the right product expert fast.

02

Shorten time to pre approval with structured intake

Collect the right data at the right time, then trigger pre approval checklist mortgage items automatically. Require income, employment, and credit details up front, route to underwriting prep, and reduce back-and-forth. Clients see clear next steps, you see fewer stalled files.

03

Eliminate document chaos and missed steps

Create repeatable workflows tied to your mortgage document checklist. Auto send secure upload links, reminder cadences, and status updates. Escalate missing items before deadlines and keep stakeholders aligned. Every borrower gets a consistent, audit-ready experience.

04

Keep your refinance and purchase pipelines moving

Build refinance pipeline management rules that nudge rate-check calls, appraisal scheduling, and closing packages. Automate status messages, internal alerts, and follow-ups after funding for reviews and referrals, improving lifetime value and repeat business.

Pipeline-aware routing

Route borrowers by product, credit profile, language, or branch. Power fair lead distribution and SLAs with flexible rules that reflect your process.

Checklist driven automations

Tie steps to the pre approval checklist mortgage and mortgage document checklist. Automatically request documents, verify completion, and trigger next actions.

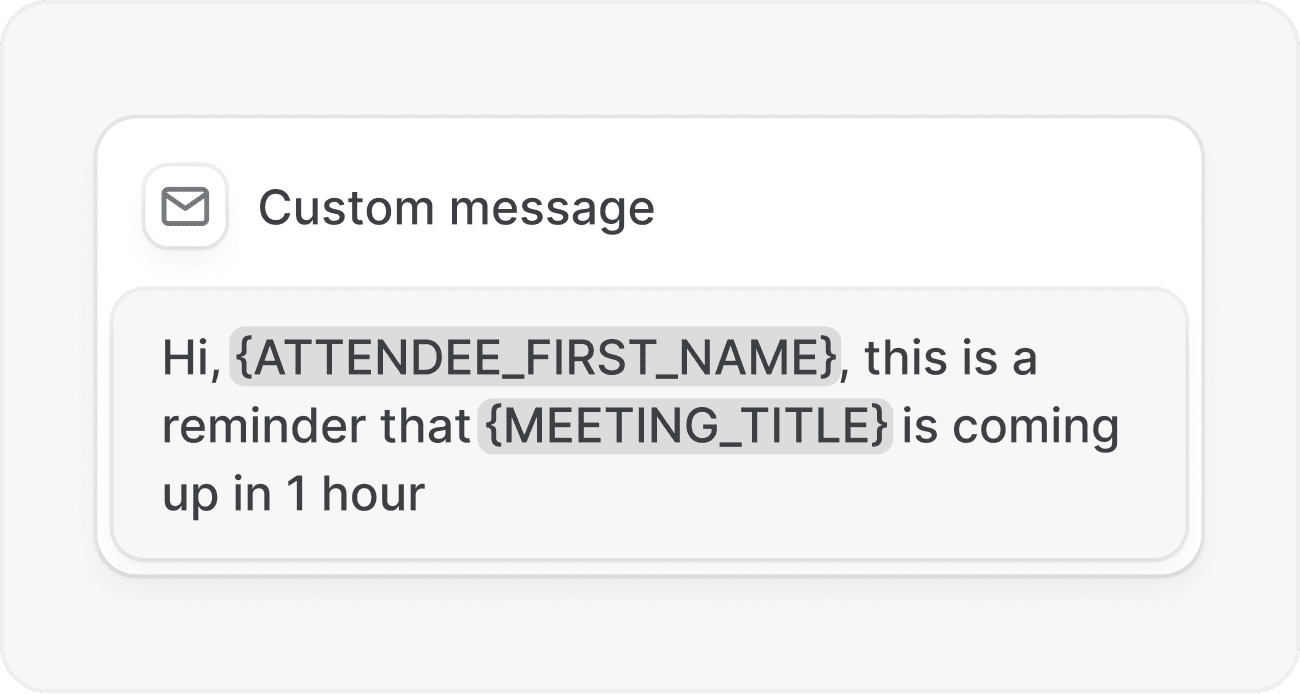

Multi channel reminders

Reduce no shows with email, SMS, and WhatsApp reminders. Customize tone and timing for each loan stage and borrower preference.

CRM and ops integrations

Post events to your CRM, loan origination system, and internal tools. Keep notes, tasks, and statuses in sync across the stack.

Self hosting and compliance controls

Run Cal.com on your infrastructure, control data residency, and apply access rules. Align with internal policies and auditor expectations.

API first and extensible

Use webhooks and APIs to program workflows, service accounts, and custom fields. Fit unique loan origination workflow steps without vendor lock-in.

How does Cal.com support a typical mortgage advisor process flow?

Define pipeline stages, set triggers per stage, and automate confirmations, reminders, and document requests. Intake fields capture borrower data while routing and availability logic align staff coverage with demand.

Can I mirror my loan origination workflow steps from our LOS and CRM?

Yes. You can map events to your LOS and CRM objects via webhooks and integrations, then trigger messages or tasks when statuses change, such as application submitted, conditional approval, or clear to close.

How do you handle a pre approval checklist mortgage inside workflows?

Create a checklist template, require key fields, and auto request documents. When items are complete, trigger the next step and notify stakeholders while maintaining a clear audit trail.

Can Cal.com help enforce our mortgage document checklist?

Yes. Use required pre-meeting questions, secure upload links, and reminder cadences. If items are missing, escalate to a teammate or reschedule conditions until compliance is met.

What options reduce no shows for rate and refinance reviews?

Enable multi channel reminders, add time zone detection, and allow easy rescheduling. Pair with refinance pipeline management triggers to keep milestones on track.

Is self hosting available for sensitive borrower data?

Yes. Cal.com supports self hosting with granular permissions and SSO. You control data residency and can meet internal compliance and vendor risk requirements.

Can developers manage workflows through the API?

Yes. The API lets you create and update workflows, templates, and availability programmatically. Use webhooks to sync status changes with your LOS and data warehouse.

Get started

Automate your borrower journey from lead to funded loan. Try hosted or self hosted, connect your stack, and build workflows that accelerate pre approval and keep every file moving.