01

Connect your calendars and availability

Sync Google, Outlook, or CalDAV calendars, set lending team availability, and prevent double bookings so every mortgage consultation and follow up fits your pipeline without conflicts.

02

Build your borrower workflow

Create intake forms, qualification logic, and reminders for the mortgage pre approval process. Route borrowers to the right home loan broker or refinance broker automatically.

03

Launch, track, and optimize

Embed booking on your site, share links, and monitor conversion. Use workflows to trigger reminders, disclosures, and post meeting tasks that keep files moving.

01

Convert more leads who search mortgage broker near me

Meet borrowers the moment they are ready. Embed instant booking on landing pages that capture traffic from searches like mortgage broker near me and best mortgage brokers. Route by loan type, language, or branch, then automate confirmations and reminders to lift show rates. With a branded experience and mobile friendly booking, you reduce friction, build trust, and turn more first touches into funded loans.

02

Shorten the mortgage pre approval process

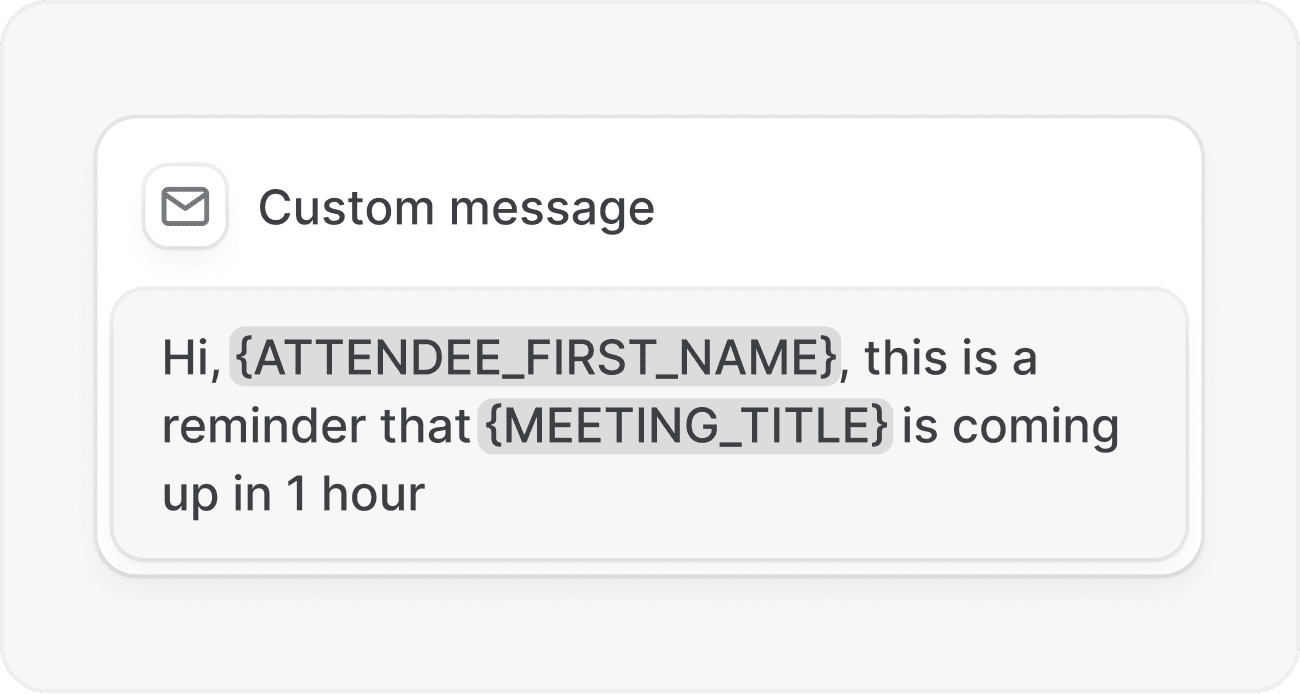

Replace phone tag with guided scheduling and smart forms. Collect income, property, and timeline details before the call, then trigger document request emails or tasks right after the meeting. Automated reminders across email, SMS, and WhatsApp keep borrowers engaged, reduce back and forth, and help loan officers move from lead to pre approval letter faster with fewer manual steps.

03

Give every borrower a white glove experience at scale

Build consistent, compliant communication for purchase and refinance journeys. Set personalized reminders for appraisal, disclosures, and rate lock deadlines. Send branded updates that make even complex steps feel simple. Whether you are a home loan broker working solo or part of a multi branch team, workflows help you deliver the same reliable experience every time.

04

Operate securely with enterprise grade flexibility

Cal.com is open source and API first, with the option to self host. Integrate with LOS, CRM, and data tools, enforce role based access, and log every action for audits. Developers can extend workflows with webhooks to update milestones or trigger underwriting tasks, while admins keep control over templates, consent, and retention settings.

Routing forms and round robin

Qualify by credit stage, loan type, or region, then route to the right loan officer automatically. Balance workloads with round robin or priority based assignment.

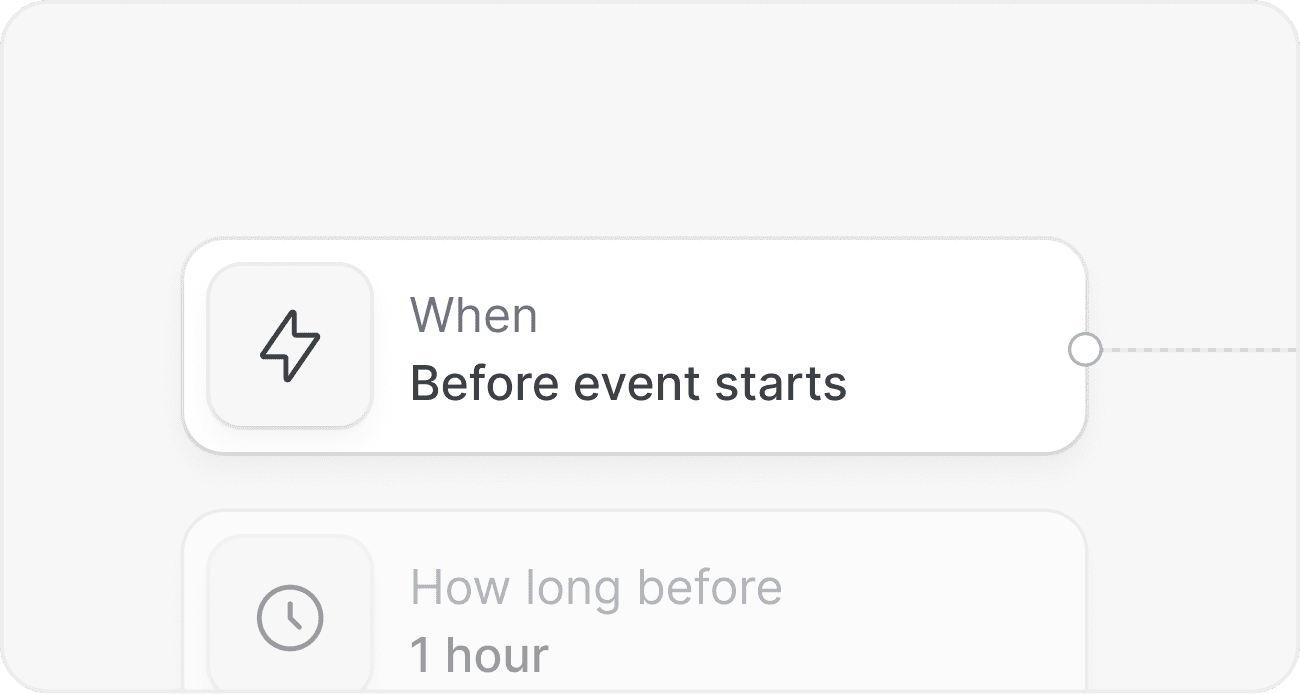

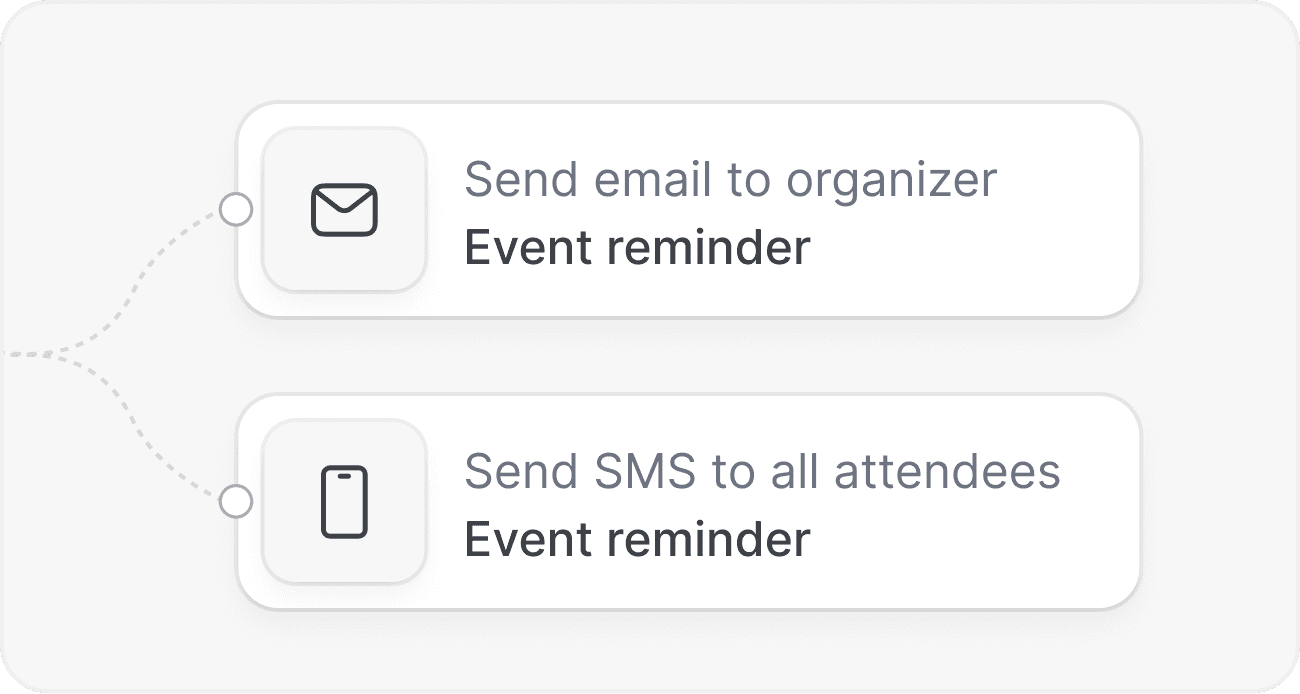

Multi channel reminders

Reduce no shows with email, SMS, and WhatsApp reminders. Customize timing for first consultations, processor check ins, and closing appointments.

Branded intake and disclosures

Collect pre meeting details with custom fields. Include NMLS, Equal Housing, and state disclosures in confirmations for a compliant borrower experience.

Embeds and links anywhere

Embed scheduling on landing pages, lead capture forms, and partner portals. Share one link for purchase, refinance, or HELOC consultations.

Developer friendly API and webhooks

Connect Cal.com to your CRM or LOS. Trigger tasks, update deal stages, or send docs when events are booked, rescheduled, or completed.

Self hosting and granular permissions

Deploy on your infrastructure for full control. Use SSO, SCIM, and role based access to secure sensitive borrower data and team settings.

How do workflows help the mortgage pre approval process?

Workflows collect key borrower info before the call, route to the right loan officer, and send reminders and follow ups automatically. After meetings, they can trigger document requests and status updates.

Can I route leads to the best loan officer by loan type or branch?

Yes. Use routing forms and rules to assign purchase, refinance, or HELOC consultations by expertise, branch, language, or availability. Round robin and priority routing are supported.

Do reminders support SMS for borrowers on the go?

Yes. Send email, SMS, and WhatsApp reminders. You control timing, frequency, and content to reduce no shows and keep borrowers engaged throughout the process.

Can Cal.com integrate with our CRM and LOS?

Cal.com is API first and supports webhooks. Teams commonly connect CRMs and underwriting tools to update stages, create tasks, and log meetings automatically.

Is self hosting available for compliance and data control?

Yes. You can self host Cal.com to meet strict security and compliance needs, while keeping full feature parity for workflows and scheduling.

How do you support teams of many loan officers?

Use team pages, round robin, and pooled availability. Admins manage templates, permissions, and branding so every borrower receives a consistent experience.

Can I use Cal.com if I am a solo home loan broker?

Absolutely. Solo brokers can launch a simple booking page, automate reminders, and grow with advanced routing and integrations when needed.

Get started with mortgage workflows

Automate consultations, reminders, and follow ups so your team closes more loans with less effort. Start free, explore the API, or request a tailored demo to see how Cal.com fits your stack.